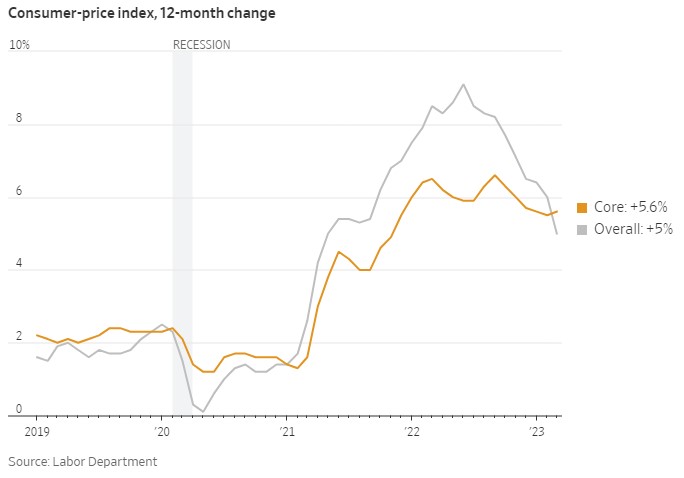

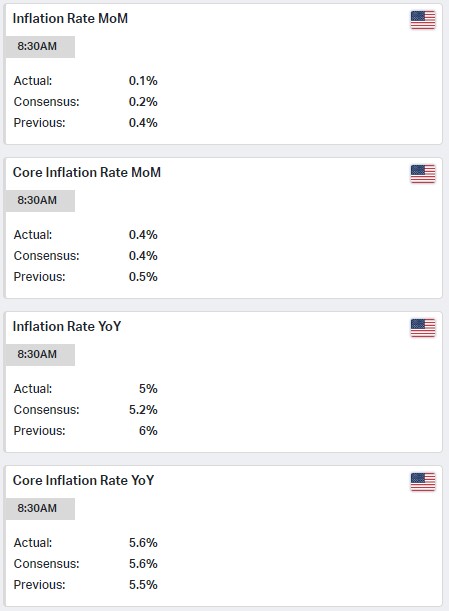

The CPI numbers out Wednesday were not that bad. The overall headline number has retreated back to an even 5%, below consensus and a full percentage point below last month. Core actually ticked higher a bit which is a little concerning. The MoM number continued to fall and also came in below consensus. Progress. ✔️

Futures were higher on the heels of the print but were faded quickly and the market ended in the red after the Fed meeting minutes were released. Chatter in there about the bank failures impacting future rate hikes had markets talking “R” word again and things went South from there.

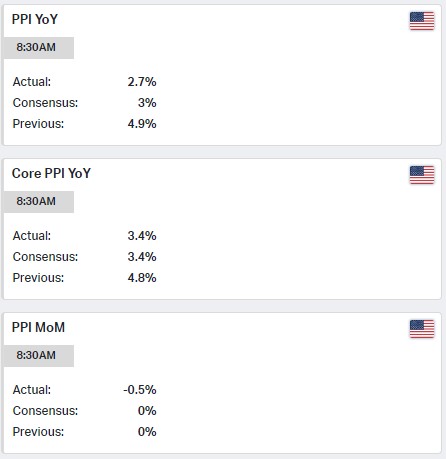

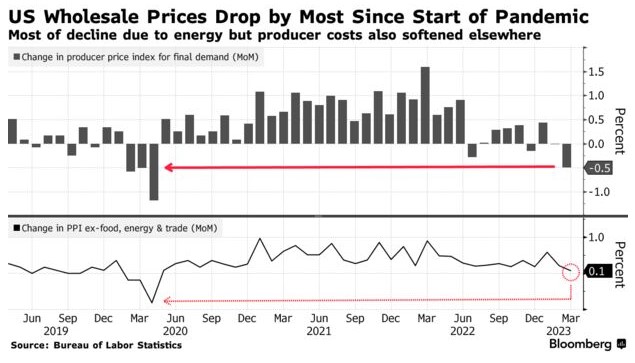

Thursday’s PPI brought even more evidence of inflation continuing to cool off. Headline YoY came in at 2.7%, below consensus and almost half the previous read of 4.9%. MoM went negative, core was in line. More progress. ✔️✔️

The market liked the affirmation and closed firmly in the green end of day Thursday, SPY closing above 412 and the upper trendline trying its best to leave my 410 ceiling behind:

The most bizarre piece of news I read Thursday was Elon Musk rebranding Twitter as “X Corp”? Whatever. According to the WSJ article, his “..goal is to create X the everything app. Twitter is an accelerant”. Elon has had his eyes on the banking business for a while.

Just what we need, one app called “X” where you can post selfies, vacation photos, videos, woke political rants, connect seamlessly with all of your “followers”, pay a bill or two, buy some crypto or pictures of bored apes while you are at it! I’m sure I left something out.

Throw in some half-ass developed AI to help manage it all, what could possibly go wrong?

I digress.

Friday will kick off bank earnings and we will get reads on retail sales and consumer sentiment. My gut tells me given where we are trading (top of the range) the street will fade the bank results into the weekend awaiting more clarity next week.

As for the consumer, I venture to guess like the other metrics above, they will continue to hold up. Look at this chart of Visa, which I refer to from time to time:

Visa is a mirror into consumer spending. I’m not saying it’s all 100% healthy spending, but from an economic perspective money is being deployed. That chart appears to me like it’s moving up and to the right and wanting to go higher. That said…

As I stated in an earlier post, this whole soft landing thing? More possible by the day.

Let’s see what the next couple weeks of earnings has to say, as we approach the first Saturday in May.

Have a good weekend.

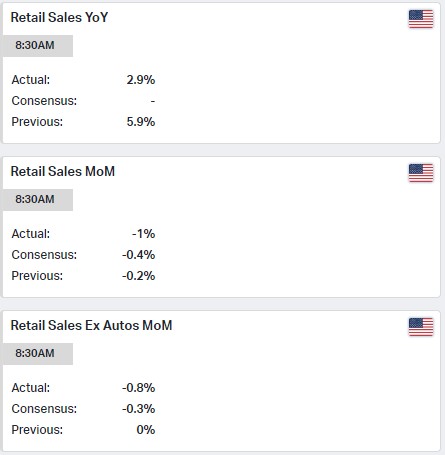

Friday AM update

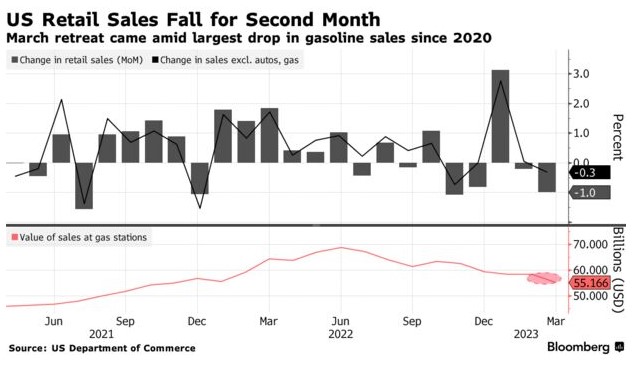

Retail sales are out and show the consumer backed off a bit last month. So if anything this will be taken as further evidence the rate hikes are taking hold as demand slows.

Very interesting setup heading into the early May Fed meeting. I would say as of today it’s a coin toss between another 25bps hike and a do nothing “pause” altogether. A couple of officials wanted that pause last month if I recall.

The data continues to point to progress. Enough? They will need to decide.