It was on the cooler side today, cloudy, spitting rain early. The sun has struggled to break through but as the clock spins, I can sense the effort. I am starting to see shadows in the office, better late than never.

I have learned to appreciate the quiet days, especially Fridays, when the market is closed and the noise seems to dissipate. Thoughts are a little more effortless, planning is a little more clear, the overall pace lends itself to a productive day.

The kind of day you realize you have solved a problem or perhaps fixed something long since broken.

Judging by the reduced traffic this week, I think it was Spring Break for the herd, where the mini-van caravan heads south to seek out warmer temps and temporary sanity.

As we approach Q1 earnings season, I think the market is taking a similar approach of escapism.

Things aren’t going to be so bad, right?

We just brushed off two bank failures, that has to count for something, right?

To be honest, we did in fact shrug off the bank drama in quick order, thanks to the quick response.

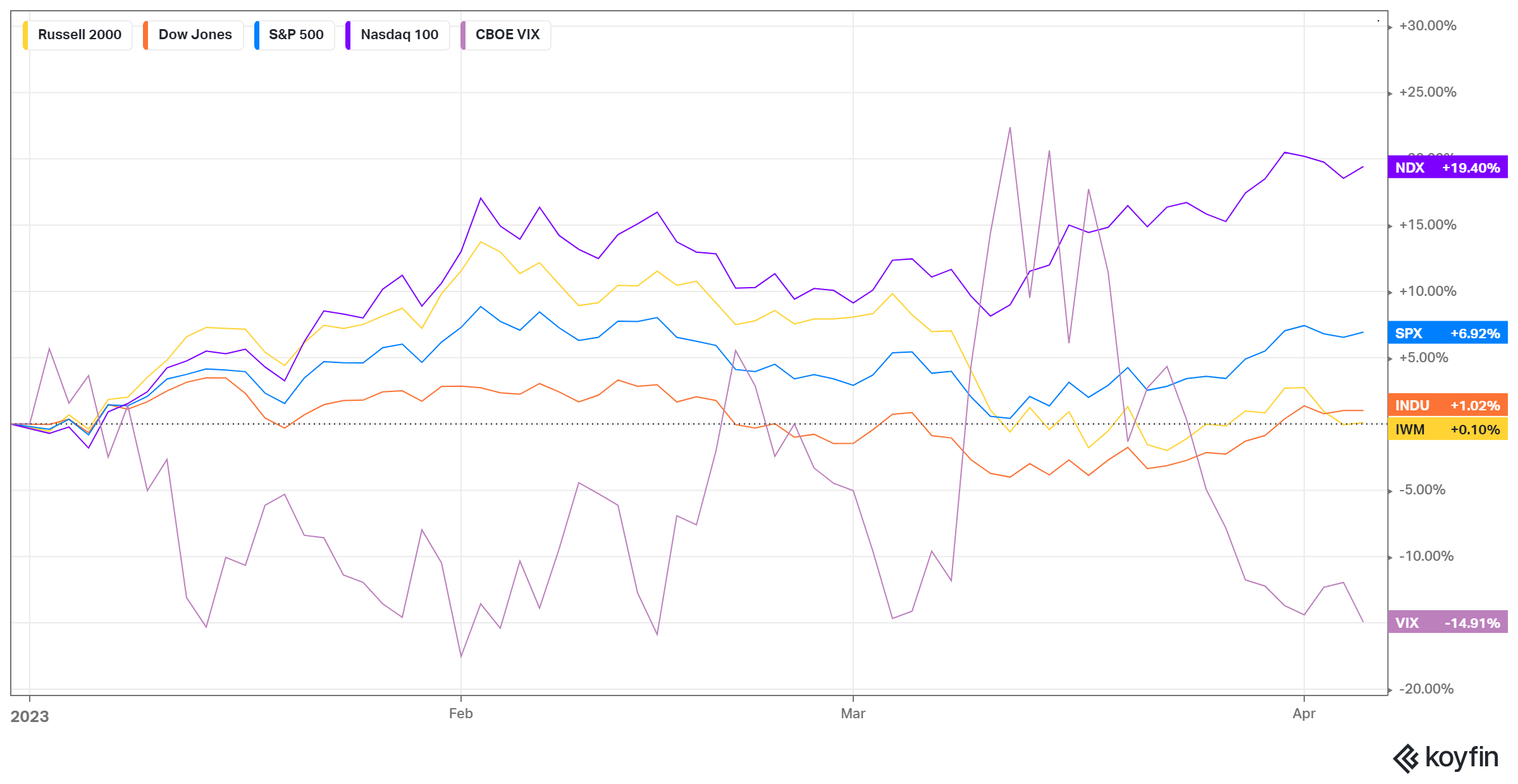

That mid-March blip in the VIX turned out to be just that, a “blip”. It faded entirely before April. Meanwhile the major indices continue to recover, with large cap tech leading the way.

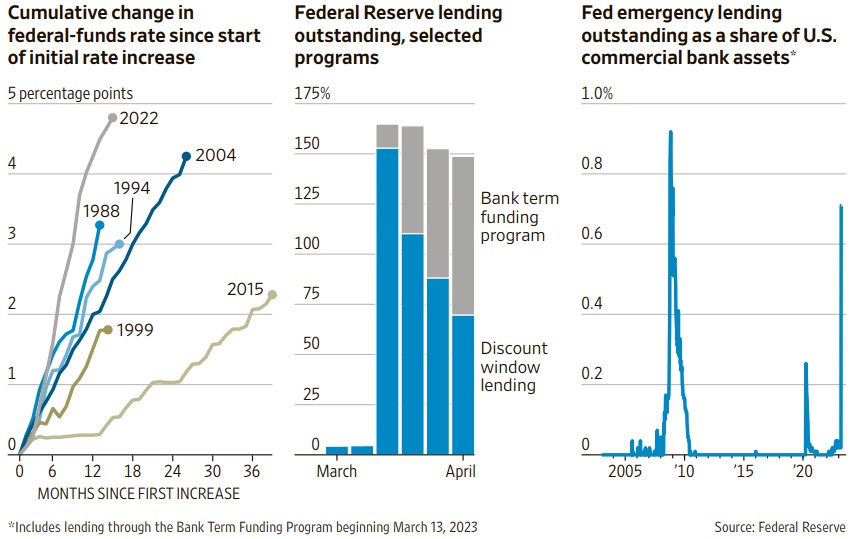

Not bad considering the “pace” of rate increases is unprecedented and we have re-entered the era of emergency lending:

When I review the SPY, I see a prop job. We are entering Q1 earnings season at the 410 level which I have viewed as the “ceiling” since the first week of January. We could re-test the prior early February highs of 415ish prior to next Friday but that would further extend the risk profile:

The buy signal generated by the 5/20 EMA cross in late March (green circle above) is still very much in play, I would just simply note the headwinds and decreasing RSI and MACD histogram noted by the declining arrows. It feels toppy to be honest, dancing on the ceiling like Lionel Richie:

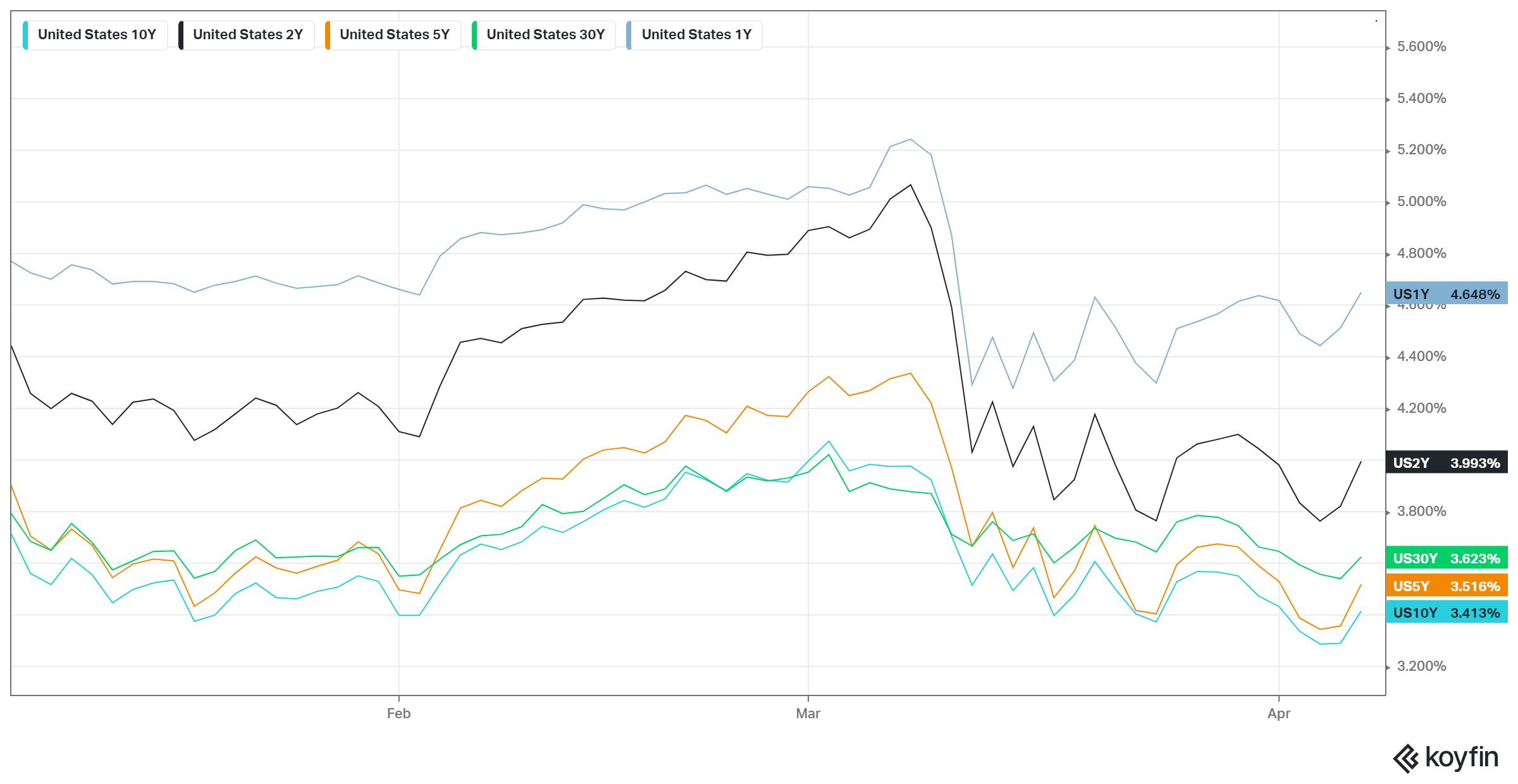

I will end with a walk through US yields. The regional bank uncertainty resulted in a swift and volatile rate re-pricing. They were marching to the beat of the Fed hikes right up to the point where they weren’t. Note the recent tick upwards, time will tell if that continues:

Bank earnings kick off one week from today. Broader earnings overall are expected to post declines and given the Fed vacuum until early May, any downside surprise or weak guidance over the next 2-3 weeks given where we are dancing now could result in some downside resettlement.

But for now… on this early Spring quiet Friday… we enjoy the cone of silence.