I haven’t been writing as much lately, it’s seasonal. Blame it on Spring and warmer weather. Been away from the desk and that my friend is a good thing.

The only thing growing however is my project list.

Sub zero temperatures over Christmas weekend seem to have taken their toll on this fella’s foliage. The front of the house looks frozen in time and I see more brown than green.

Looks like mother nature and father time have caught up with me this year and I see a shovel and some planting in my future. Could also be a trusted landscaper phone call, time will tell.

So let’s talk about the landscape a little, as we enter the end of Q1. I thought when I “retired” (per se) time would slow down but it has done just the opposite. Do keep that in mind!

My financial goal is always the same: Positive Equity Curve.

That is a fancy way of saying the portfolio grows, dividends accumulate, trading profits exceed trading losses and things stay – Green. Unlike my magnolia.

Arbor activity aside, let’s review some topics from Q1…

BANKS

Nobody saw this one coming. I wrote about it in Silicon Valley Bust, and little did I know bank #2 would be hot on its heels. Had it not been for the swift weekend reaction from the Fed and the FDIC, things would/could have gotten much worse.

Money is still transferring from little bank to big bank. This will continue.

Exhibit A:

Banking is about one thing and one thing only. Confidence. Bank runs have been around for centuries but now they happen via smartphone. No long lines baking in the sun on the sidewalk, you just click “transfer funds” on your iPhone sitting at the next stoplight.

SVB found that out the hard way.

When cash must be raised, you must sell. Period. Doesn’t really matter at this point that you ignored interest rate risk and had nowhere else to go way back when with an influx of cash except to long bonds, you need it now, so you must sell NOW. Meanwhile, the big banks were transitioning to “hold to maturity” mode, which means those losses mean nothing (right now) because unlike SVB, they don’t need the money (right now).

Not going to spend any more time on it, I think we come out of this OK but make no mistake, this is the beginning of a slow motion reckoning that will work itself out over time.

INFLATION

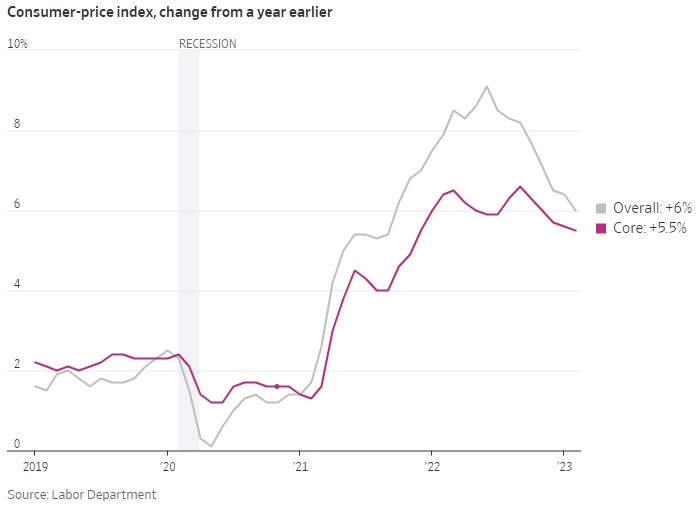

More people are tracking inflation now than ever. I can’t walk into a room without hearing the word. First it was gas. Then it was eggs. More people know what CPI is than in the history of this great nation.

Somewhere in there I suppose is “transitory”. Do you see it? I don’t either. Looks like a pretty fast and steadfast transition to me.

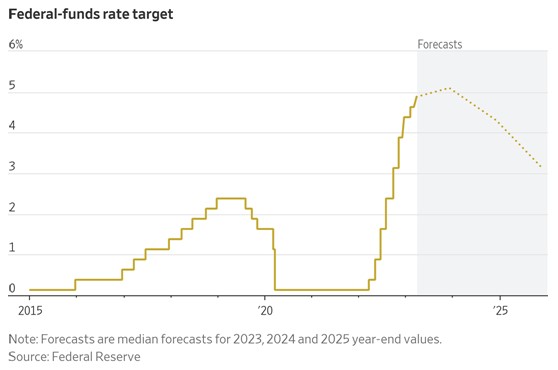

It’s coming down now, that’s the good news, but that came at the price of fast and steep rate hikes that are most likely still not done:

Forecasts for rate cuts are clearly visible, some as soon as Q3 this year. As I have stated in earlier posts, be careful what you wish for. If this pulls forward, something broke.

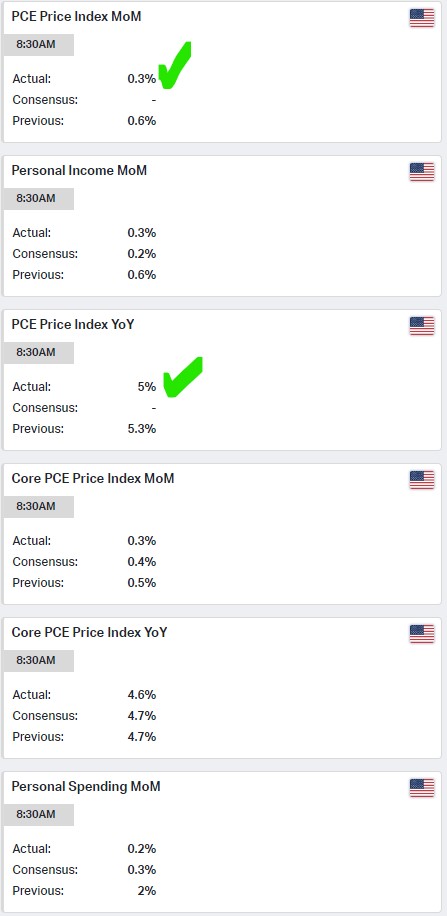

Next CPI read will drop on April 12th. PCE which the Fed watches closely was out today and I see more progress in reduction and more importantly no upside surprises:

market technicals

So given all of the above, where are we?

The great thing about viewing the market in technical terms is nothing else matters. You get to see what all of the above has translated into in graphical form.

What I wrote about during the first week of the year in Range Bound still holds true:

We are filling in the blanks between 360-410 until something “gives”, good or bad, inflation gone or recession here, one way or the other. I could talk about financials, techs, small caps, industrials, bottom line I don’t really need to. Put on some music and watch the transition above picturing it continuing ever so slowly into the future…

Nearer term I will mention that as we exit Q1 today, SPY did finally confirm the buy signal with a 5/20 EMA crossover and we have been gapping up since Wednesday. RSI is above 50 and rising, the MACD is positive and rising. Very healthy, but just keep in mind we are still below the 410 level I mention above and we will need to push above that level for this rally to continue.

yields

I mentioned in an earlier post that bonds had been trading like a small cap biotech stock and I meant it. Bond volatility this year has spooked me more than anything equity wise because quite simply bonds are not supposed to trade like this!

The yield reset post SVB has been swift and has no doubt provided some equity lift as well:

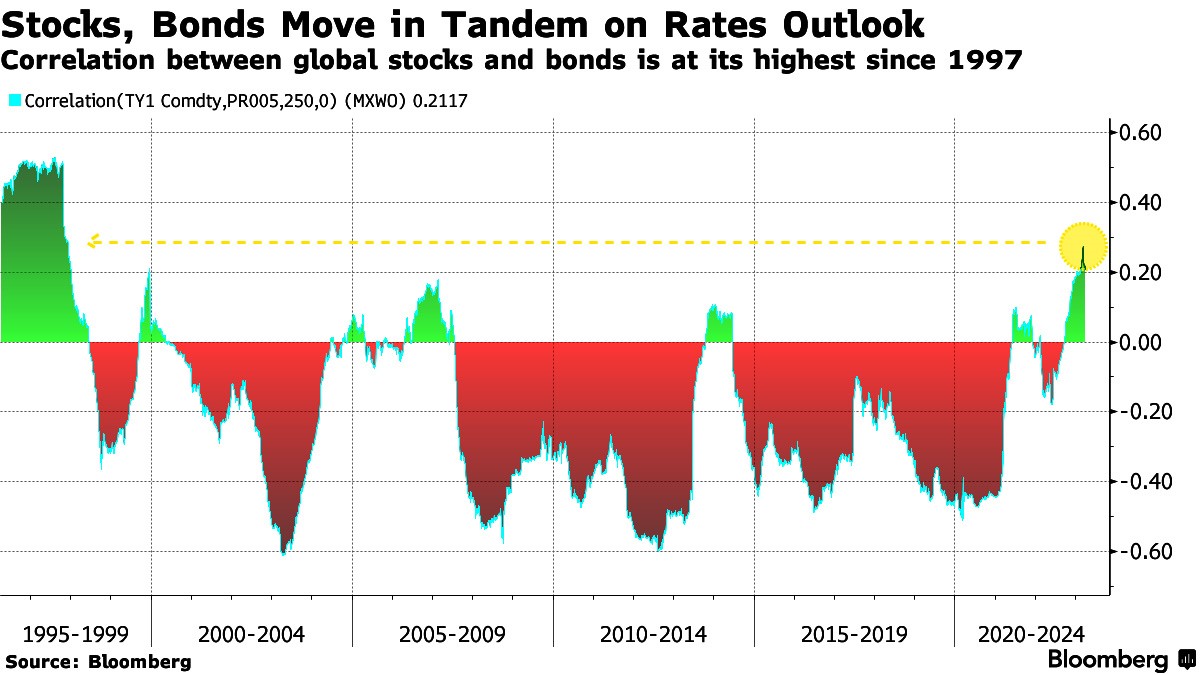

Another vexing observation was the recent correlation between stocks and bonds:

Not sure what to make of this really but when you compare today to previous periods of “green”, nothing good is happening during those green periods!

volatility

There is none. The VIX is calm as can be exiting Q1, firmly below 20:

Now to a topic not so calm…

geopolitics

I made an oath when I started blogging again that I would not venture into politics. I lean right and will leave it at that. I am not here to promote that nor defile those who don’t, I am here to blog about markets and financial planning topics that interest me (and hopefully you).

That said however, there is no denying this backdrop. There is so much going on right now, behind the scenes, that anything is possible marketwise as we look ahead…

- No end in sight with Russia’s unprovoked invasion of Ukraine, now entering year 2

- A WSJ reporter was detained in Russia yesterday on spying charges

- The US recently decided to stop sharing nuclear information with Russia

- China and Russia continue to strengthen ties

- We are shooting down Chinese spy balloons with jets and sidewinder missiles

- Taiwan’s president is in the US as China threatens escalation for the visit

- One of the lead articles in this past weekend’s WSJ was how to prepare for a conflict with China.

I think it’s a very fair statement to say we are entering a new cold war period.

Meanwhile in the states, media headlines are dominated by school shootings and criminal indictments of former presidents. 2024 is an election year and Biden is seeking re-election at 80. His vice president is woefully inept.

All of this, what is shaping up to be a circus in 2024 combined with the increasingly fraught geopolitical landscape leading up to it scares the hell out of me.

I am not doom and gloom, not Mr. Cash only and I am not building any bunkers. But given my daily participation and market exposure I am most certainly a realist. I will stay invested but I will also stay nimble.

Especially with this backdrop.

The good news glass half full view as we leave Q1 behind would say markets are stable and turning up while inflation is on its way down. We absorbed two bank failures with little impact and the consumer remains very resilient.

It will be interesting to see how Q1 earnings shape up, which oddly enough the banks will kick off in a couple short weeks. Traction from cost cutting measures, especially in tech, will need to be on full display and reflected in future guidance.

All in all, it could have been a lot worse. I am definitely trying to be optimistic entering Q2 and think this whole soft landing thing is becoming closer to reality.

Zooming out on a global scale however, the reflection of the overall landscape may not be as calm as it would seem.

Stay nimble.