I will be the first to admit my tendency is to go all in.

Projects, new ideas, the “what” doesn’t really matter – it usually boils down to how committed I am, how convinced I am of the ultimate vision my brain has concocted.

I am not an entrepreneur. Unfortunately I am not that smart, but I do fully understand the spirit.

That spirit is a driving force you cannot define to others, no matter how much they ask you to, you just know it’s there, directing your thoughts and focusing your attention to something you and possibly only you know to be possible.

This can be a gift and also a curse when it comes to investing. Stick around long enough and you will catch a lightning bolt, scurry off to read and research more just to be absolutely sure. Once confirmed?

All in.

If this was the WPT, your fate would be determined pretty quickly. You live to play again tomorrow or go home.

In investing, it’s not so straightforward. I have all too often allowed losing short-term trades to become long-term investments. The key for me is account/rule/goal separation that allows for flexibility but at the same time provides some clearly defined guardrails.

WB (Warren Buffett – not me) famously quipped “Diversification makes very little sense for anyone that knows what they are doing”. I love that. It has humbled me many times after failed bets and pushes me to focus and identify where I need to be while avoiding places I don’t.

My favorite movie is Tombstone. At one point a (rare) sober Doc Holliday offers to fight a raging drunken Johnny Ringo in the street, to “play for blood”. Realizing Doc’s sobriety and Johnny’s obvious vulnerability, Curly Bill Brocius grabs Johnny and pulls him back from an early death.

“Easy…easy son, Now ain’t the time!!”

Curly Bill Brocius

Hold that thought.

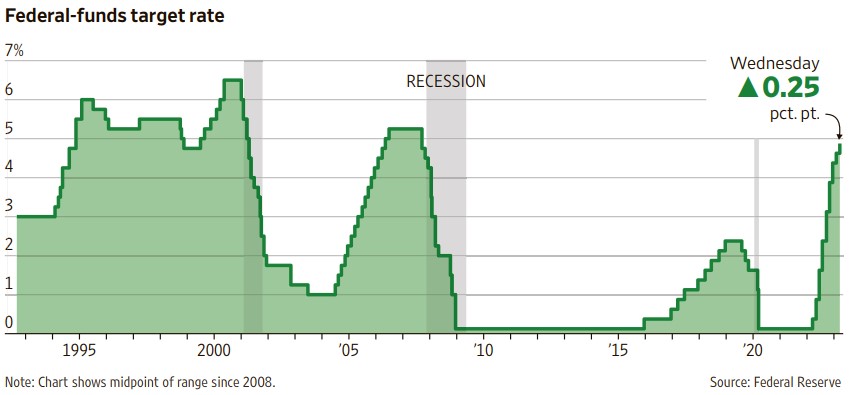

As we still try to digest the 2nd and 3rd largest bank failures in history, the Fed raised rates a very predictable 25bps this week. Those failures my friend are the only reason you and I didn’t see 50. The Fed knows a portion of “tightening” will now take care of itself as credit dries up.

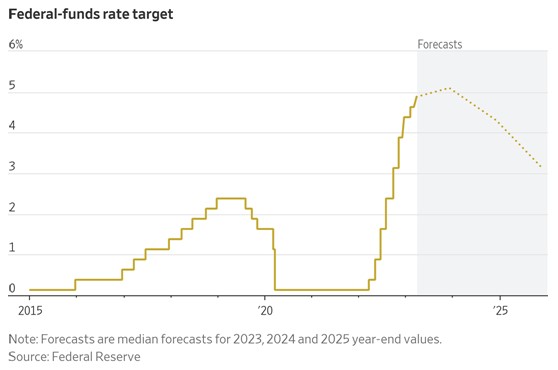

I think it’s also worth noting I am starting to hear “They are done” discussions. Perhaps. Projections actually call for rate reductions in the near future. Don’t get too excited about these because if they pull forward that means something either “broke” or we tipped into a recession.

I am trying to focus on the longer term market cycle and what we all want to see now is continued reduction in inflation without bank failures, without the R word. Fingers crossed. I’m running out of fingers.

First quarter bank earnings will kick off on Friday April 14th, 3 short weeks from today. The next Fed decision will not come until May 3rd. Now that Spring has Sprung, I would argue we now enter an equally fragile period for markets as well.

Post Fed this week, the SPY attempted a 5/20 EMA bullish crossover and failed. It would have been the first such event since January 10th. Instead, overhead resistance abounds, in the form of just about every major moving average one can name and relative strength (RSI) is decreasing.

The charts are screaming sideways to down from here at best until we get more data or drama entering the next earnings season.

10y yields are back below 3.5% and the VIX is attempting to base in the mid 20’s. I think all eyes are still on the banks for any future trouble, I see Deutche Bank in the headlines today.

Times like this are when traders and investors alike are seeking opportunity and we all feel the need to be doing something. Overcoming that urge is not easy, especially caught in a vacuum before the next round of earnings, CPI data and Fed meeting.

I have learned over the course of 20+ years dabbling in the markets to appreciate Dry Powder. The official antithesis to my all in tendency, cash on the sidelines provides options. Sitting on hands provides options.

I refer back to Curly Bill…”Now ain’t the time….”

The dust needs to settle on the Financials and market technicals needs to improve. Time to get outside and take a walk, get some air. Find the next good book to get into.

Dry powder at the ready could be a good thing, should the clouds break and clarity ensue.