Wasn’t really sure how this week was going to start. The SVB bomb drop followed up by the FDIC backstop calmed nerves heading into a busy week, but as you can imagine, the fallout and shakeout is far from over. Regional Banks continue to sway.

Money poured into the mega banks as to be expected. I can picture Jamie Dimon throwing open the doors, putting a door stop in place and saying “Come on in, the water’s fine!”. Money will be let’s say… redistributing itself…for months to come no doubt. Disclosure: I bank at Chase.

At any rate Monday was mostly green when it could have just as easily been a bloodbath. Weekend conversations dreaded the thought of the market “trying” to price in the default. It didn’t have to (at least this time around).

Ray Dalio provided a thorough response on LinkedIn with his take on SVB and the conditions surrounding it. It is definitely worth the read and inspired the title of this post.

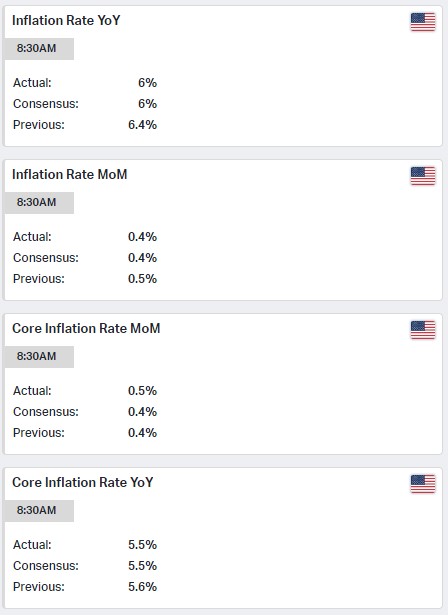

Thankfully there were no more bombs with the highly anticipated CPI:

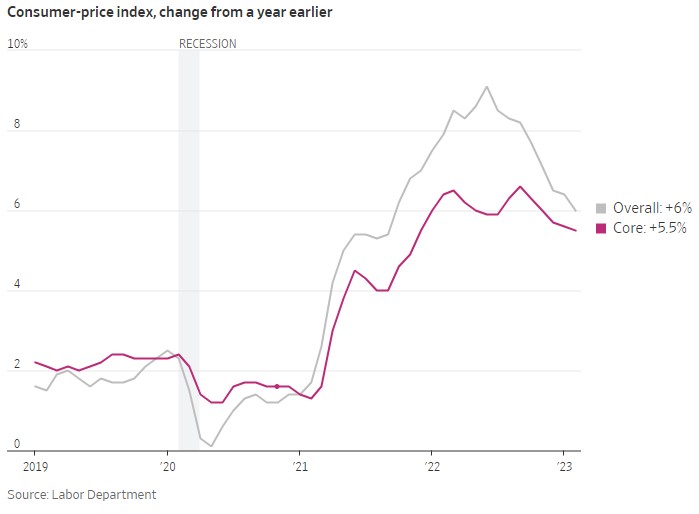

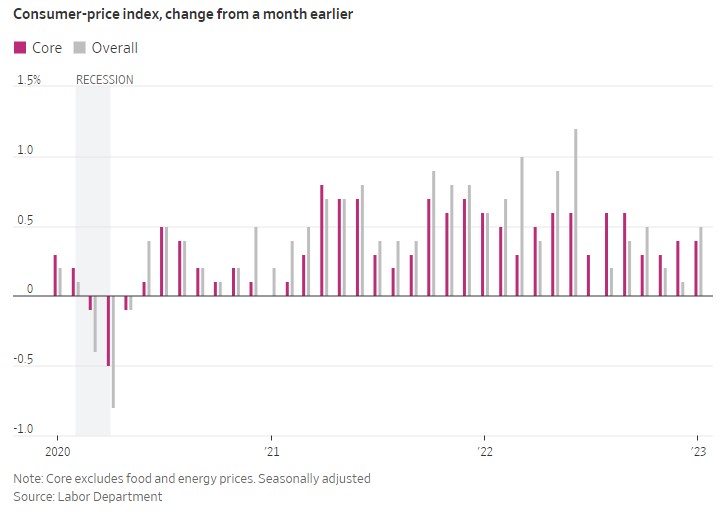

If you just look at the headline print of 6%, you can clearly see progress and a continued descent from last month’s 6.4%, not a leveling off. Core declined as well.

On the Month over Month however, we saw a slight tick up of 0.5% so the short term view is still increasing. Pesky and persistent, not really subsiding materially since the pandemic.

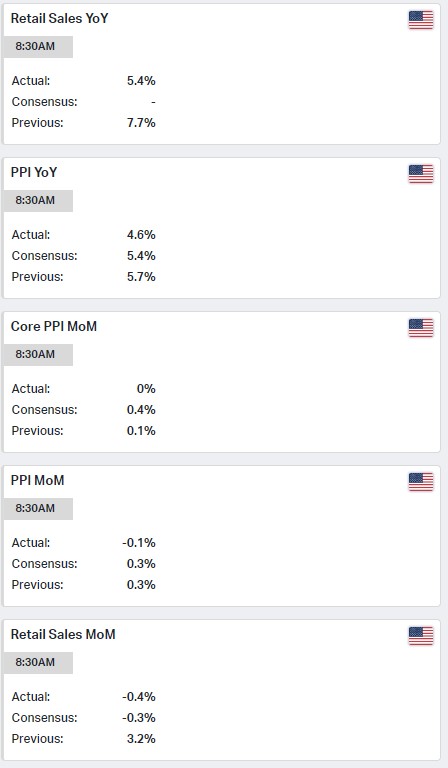

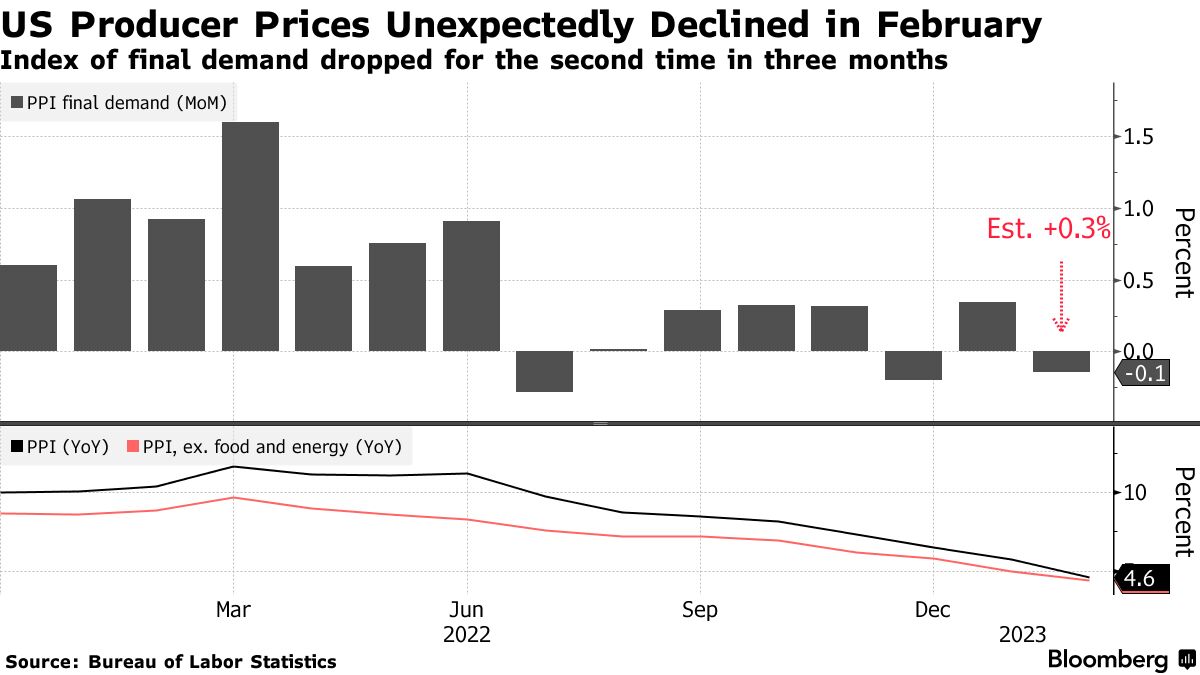

Further inflation easing evidence with Wednesday’s PPI:

Headline came in at 4.6% firmly below the 5.4% consensus. Core, Monthly numbers also came in below consensus, more food for thought as the Fed debates the 25bps move next week. After this weeks data and drama, 50bps is off the table, if anything a pause is now in play.

Retail sales were up 5.4% below the previous 7.7% and saw a MoM decline as well at -0.4% following lasts month’s 3.2%. Consumer spending is strong but slowing.

In the wake of all the bank drama, the treasury market has continued to trade like a small cap biotech stock. All over the place, all week long. The SVB fallout triggered a massive downward repricing in yields as the flight to safety rallied bonds across the curve.

10yr yields which had briefly danced above 4% are now back below 3.5% as of Thursday. The move in the 2yr was even more pronounced. Very uncommon and unsettling to see bonds trading like this, it’s nuts for lack of a more technical term. This will ease mortgage rates on a positive note.

Reader note: These are intra-day Thursday charts below and do not reflect the entire week.

The VIX has settled into the mid 20’s as everyone enters risk assessment mode after SVB, I expect it to drift back to 20 before the Fed decision next week, assuming no more bank sector surprises.

Lastly, SPY lost its 200day and is trying to recover and retake as we approach the end of the week. All three key moving averages are now overhead resistance heading into the Fed meeting.

I defer to my previous Range Bound 360-410 thesis, and as you can see below, we just continue to fill in the blanks in a sideways drift:

All for now. Been a crazy week and I am more than willing to pull the plug on it early. Michigan consumer sentiment tomorrow and production numbers shouldn’t move the needle much.

March Madness is underway and this time around? It’s not just basketball!

Here’s to clearing skies, one would hope, especially in the Valley. Enjoy the weekend.