Contagion or containment, those were the words of the weekend being spoken around the globe.

It’s been a while since I was eager to watch the news feeds on a Sunday afternoon, usually when I am doing that it’s not for good reasons!

I won’t beleaguer the issue here which has already been discussed ad nauseam, but what happens over these next few Sunday evening hours is critical. Is today selection Sunday too? Oh well, March Madness started early on the west coast.

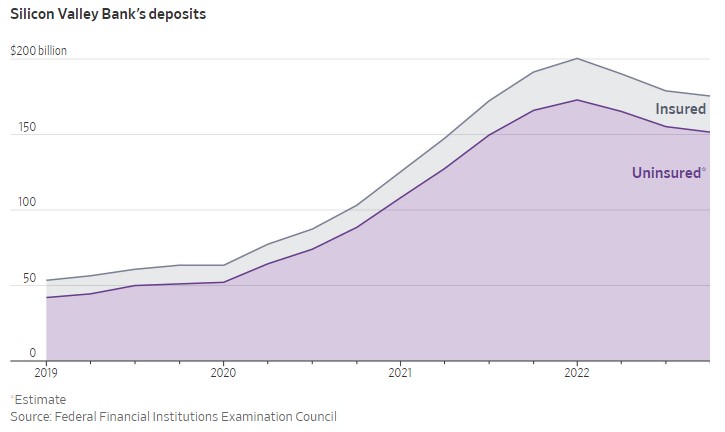

The majority of SVB deposits were uninsured. Hundreds of smaller VC backed start-ups and tech-focused companies in their early stages had used SVB for cash holdings well above and beyond the insured $250K.

The same way founders were tripping over themselves to pull money out Thursday and Friday, they were equally flooding SVB with deposits since 2020. As you can see above, deposits quadrupled, driven in part by other incentives to trust SVB with those monies, especially among the start-up crowd.

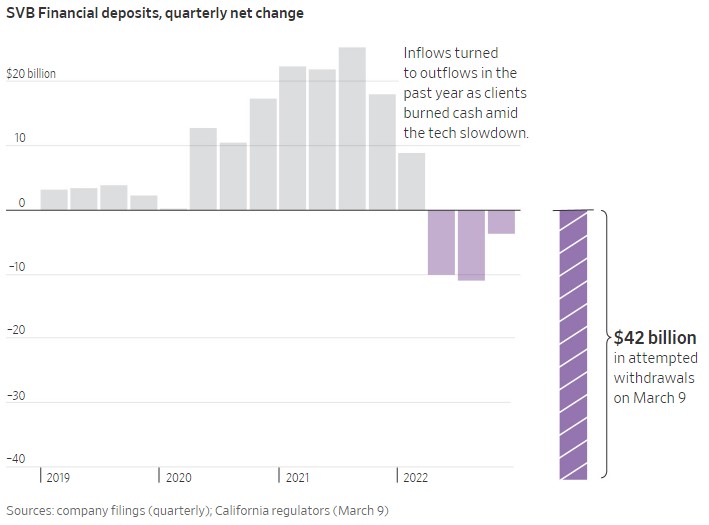

Here is a good visual also from the WSJ on the magnitude of withdrawal attempts:

Note the withdrawals actually started early in 2022.

So first, forget about the accounts with $250K or less. A small drop in the bucket compared to the ~150B of uninsured deposits. Within that swath is the lifeblood, literally and figuratively, for many small business and their employees. It was placed there so it could be drawn upon, as needed, as the leaders and founders of those businesses worked to create, cultivate, grow and secure the businesses of tomorrow.

To simply walk away from those business is not an option. I have read a lot of table pounding posts and articles this weekend echoing that sentiment, the fallout of doing nothing is not really an option here.

The latest news articles early Sunday afternoon are saying an auction process is underway for SVB assets which will help secure, if not totally secure those deposits depicted above. That will allow those small businesses to continue to operate and regroup while the remainder of the Regional Banking sector does the same.

I would hope that privately funded takeover announcement is made today, not tonight and definitely not tomorrow. Clock is ticking…

In other news

If you still need a little more excitement, we have another full docket of Econ data on tap:

- Tuesday: CPI

- Wednesday: PPI and Retail Sales

- Thursday: Housing Starts

- Friday: UofM Consumer Sentiment

- The Next Week: FOMC decision

Suffice it to say, the daily news stack above would have been more than enough. Throw in a bank failure that occurred in just 44 hours and all spotlights just seem to shine a little brighter.

Regardless of the numbers above, I will (personally, at this specific moment in time) be shocked if the Fed goes 50pbs at that next meeting. I think 25bps followed by a month off in April is much more realistic given this latest “ripple“.

For now? We wait…

6:30pm UPDATE: US Says All SVB Deposits Safe