I was away from my desk Thursday afternoon, as I am most afternoons. I set a few price alerts before heading out to run some errands just so I would know if anything was moving.

When I returned I casually glanced at my screen and noticed SPY was in a slow bleed on very low volume. “Selling into a vacuum” ahead of the jobs data tomorrow I thought, not a big deal, I didn’t expect many buyers ahead of a key CPI release next week.

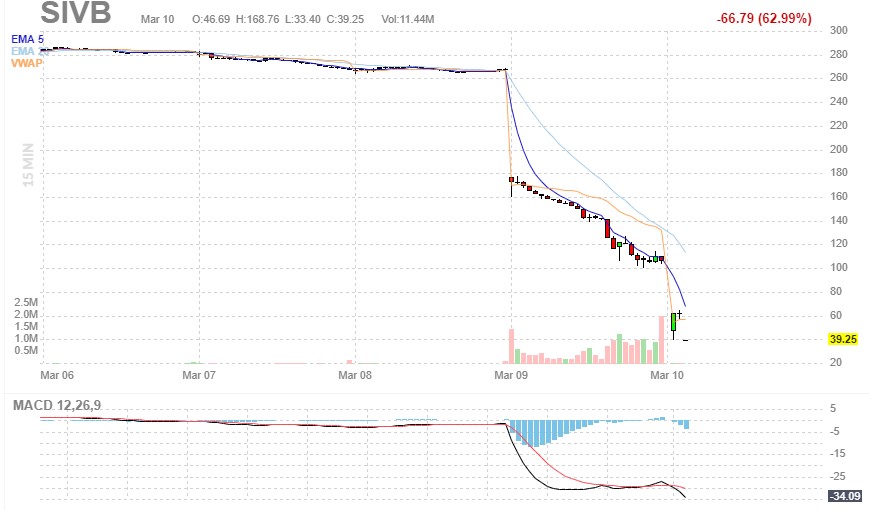

Not sure exactly at what point I noticed the daily chart for Silicon Valley Bank (SIVB), I guess it passed across the Bloomberg coverage minimized in the lower right hand of my screen. It had opened the day around 176 after closing Wednesday at 267.83. Another crypto blowup or something I thought.

The chart had no bottom and it closed at 106.04. Then it dawned on me, the market reaction I was seeing, that broader slow bleed, was just following this one story. I found that odd. When you see the tail wag the dog like this, something bigger is brewing.

I then read the Bloomberg piece about Peter Thiel’s Founders Fund advising companies to pull money from the bank following concerns about it’s stability. Do not risk more than the FDIC insured amount. I see the bank’s CEO was now advising clients to “stay calm”.

They didn’t.

So…this is how a run on a bank works in 2023.

Presumed to be operating normal end of day Wednesday, shuttered by regulators and taken over by the FDIC before noon Friday.

If that doesn’t scare the hell out of a new generation of investors, it should. Silvergate? Gone. Silicon Valley Bank? Gone.

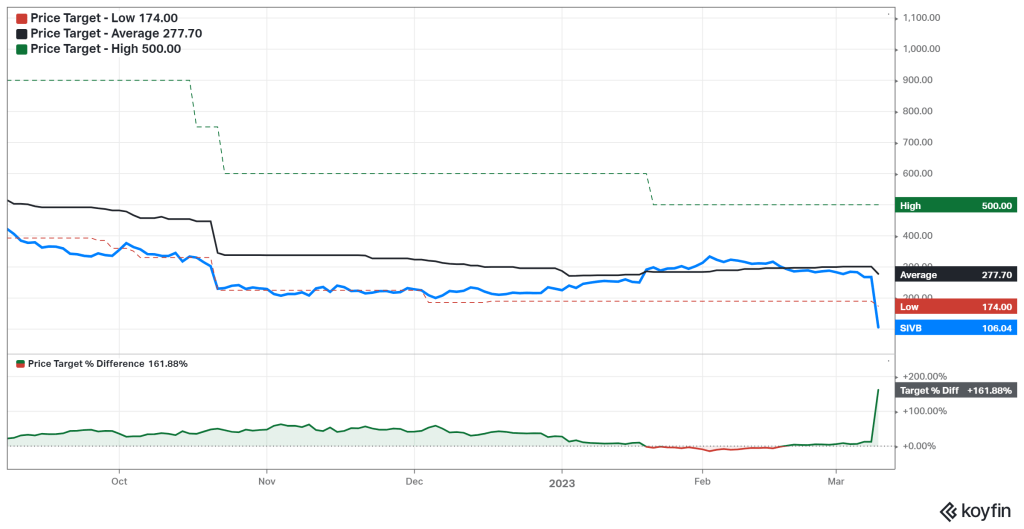

Let’s rewind a minute first. As of this morning the average price target for SIVB was 277.70, within a low-hi range of 174 and 500. Someone had a 500 price target on this stock.

What about ETF exposure? 192 were invested for a total of 10.54M shares. I assume the 3x levered Regional Banks Bull symbol “DPST” is for “deposit”. After today it will look more like “dumpster”. This swoon should be temporary, as the majority of regionals are fine, but welcome to the risks of concentrated and triple levered exposure.

I started reading up on it a bit last night, and I recall one mention of the bank being levered 185:1. I don’t know if that was the case or not, but no doubt this recent debt reshuffling they had to do raised the curtain on a shit show.

So today we begin to deal with the fallout.

Get ready for the word “contagion”, everybody will want to know how this happened and most importantly, who is next? Get ready for the word “containment” also. In my own personal humble opinion, I think this scenario will turn out to be an outlier and contained.

That doesn’t mean it won’t spook Mr. Market, it already has. As I am writing this, before shutting down for the weekend the VIX is up 25% back over 28 and the 10yr note is down below 3.7%. It was hovering around 4% just two days ago. Fear + Flight to Safety.

Still many layers of this onion to peel away before the dust settles. Probably worth noting all this drama will likely lock the Fed into a 25bps hike post CPI vs. the recently debated 50bps, but let’s worry about that then. That is over a week away.

A lot can happen in a week.

A lot can happen in two days.

Ask Silicon Valley Bank.

UPDATE: Here is the latest 7 point Bloomberg Synopsis on the failure