Not much to ponder this week as we appear to be in broken record mode. Same story, same price action, same articles anticipating the Fed’s next move.

Some key dates to keep in mind. The next read on CPI is on Tuesday, March 14th. The next Fed meeting is exactly one week later. Some are calling for a 50bps hike at that meeting, which is doubtful unless that CPI print levels off even further or (God forbid) flatlines.

I think the message is pretty clear, the Fed wants 2 maybe 3 more 25bps moves before a long pause.

The bigger issue in my opinion, at least in the short term, is the Fed will not meet again after the March meeting until May 2-3. That leaves the entire month of April, including another CPI update on April 12th, before the Fed can react or respond. That time vacuum could no doubt lead to some market overreactions with any and all data that hits the wire. Recipe for Whipsaw City.

The real story today is not in stocks, you have to look at the bond market right now to get a feel for what is being priced in.

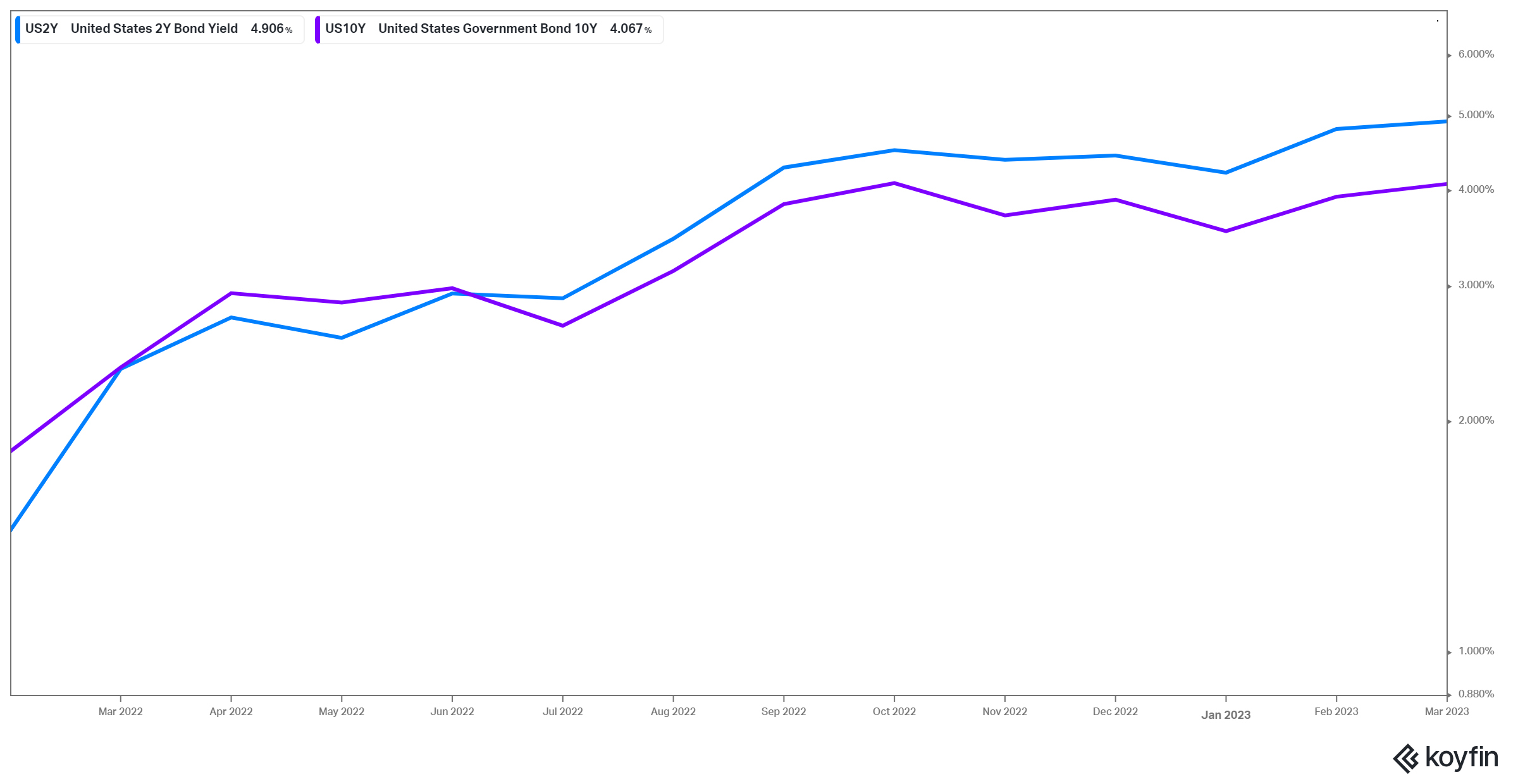

The 10yr note has been knocking on 4% again, we were there last year and the retreat was welcome news for mortgage shoppers. Now that we have once again clearly passed that pinnacle, it will soon manifest itself in 7%+ mortgage rates.

If you look further up the yield curve, even higher rates await. The 2 yr now touching 5%. The 2-10 inversion that occurred in June has widened to almost a full percent.

The home page of my brokerage firm now proudly announces 4.2% on your cash holdings! (It is nice to finally see a decent risk free return on idle cash for the first time since...pre GFC maybe?)

I noticed today even the back end of the curve was perking up, as if it realized there was some catching up to do.

Remember the used car price frenzy? Which only recently started coming back to earth, also clipped by the higher borrowing rates. Well, the cost of paying to play has come home to roost, in the form of underwater loans and $1,000 car payments nobody can afford anymore (assuming they could in the first place).

$1,000 car payments? You better have a loan term of 48 months or less, making an easy six figures and worth an easy seven if you are spending that much on a (rapidly) depreciating asset. I will Forrest Gump it right there, “That’s all I have to say about that.”

Turning to markets, I sound like a broken record I know, but I stand by my assertion 410 is the top on SPY until something gives on the inflation front or the war front. A welcome cease fire in Eastern Europe or some type of resolution there would warrant some repricing, not to mention rejoicing for more important aspects of life, topics like continuing humanity.

We are range bound otherwise, with a (very thin particle board) floor at 360. Would not surprise me one bit if we exit 2023 in this range, or 2029 for that matter. Remember what I said about money markets earning 4.2%? Put some there, a decent percentage, take a walk! Take a cruise! This range will be here when you get back.

I really don’t think the reality of prolonged 7%, 8% mortgages and 12%, 13% car loans and 19%, 20%+ credit card APRs have sunk in yet. I hope I am wrong and rates become manageable, but make no mistake…the era of free and easy money is over. That ship has sailed.

I am starting to really really take a close look at what role dividends play in my overall returns. The pandemic swoon followed by the sugar high of free easy money for all is going to fully unwind. Earnings will continue to retract and risk assets look very different when now pared against 4% cash yields.

Further out on the risk spectrum I see some well capitalized BDC’s paying upwards of 10%, some on a monthly basis. Higher rates = higher payouts there, as long as they make wise investment choices and companies can pay their debts. I own a few and will continue to research more.

Sideways market or no, the dividends will still arrive. That and given the fact it may take well into Summer or beyond to see who has won (or lost) this inflation battle, leans toward a more disciplined, dare I say, more relaxed approach to investing.

There simply is no rush.

Which is not a bad thing…in early Spring.