More inflation data out today and I will get right to it. We’re not there yet.

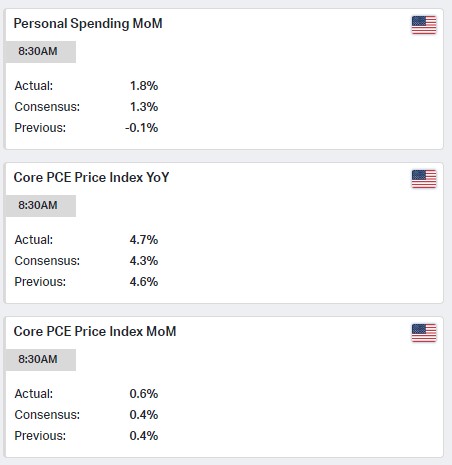

It’s certainly no secret the Fed watches the PCE prints and Personal Spending to get a read on the inflation fight. Those figures came in hot today, here are three in particular:

Personal spending MoM increased 1.8%, coming in above the 1.3% consensus and a stark contrast to the negative print last month. Consumer still resilient.

Core PCE Price Index YoY was 4.7%, also ahead of both the 4.3% consensus and previous month’s 4.6%.

Finally, the Core PCE MoM number was 0.6% vs. the flat reading of 0.4% that was expected.

All of the above leads to simply one conclusion: Inflation is stubborn, sticky and is not coming down nearly as fast as the Fed would like. This will reinforce the higher for longer mantra and will also reintroduce the potential for more hikes entering the second half of the year.

Up to this point 25bps increases were priced in for March and May, Goldman has made it clear they expect 25bps exiting the June meeting also.

After these numbers today, if anything June is now a higher probability and we will no doubt start to hear chatter for a full 100bps left to go.

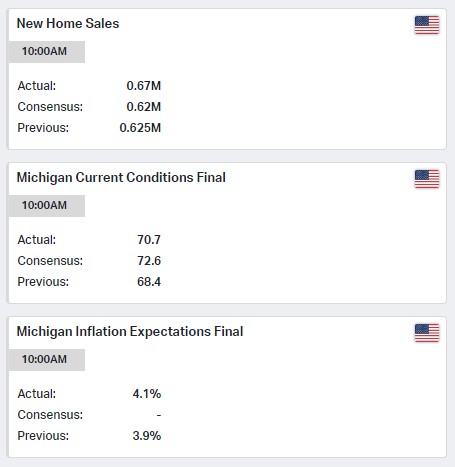

New home sales ticked higher, boosted by the lower mortgage rates, but I don’t expect that trend to continue much further. The 10yr yield appears to be headed back to 4% and potentially retest the Q4 highs. If it does it will take the 30yr mortgage rates right back to 7%+ at the peak of the buying season.

Inflation Expectations out from the University of Michigan show two ticks higher at 4.1%, and the current conditions read came in a little light.

Nothing more to add really, the technicals on every major index I look at are broken…pointing to more downside or sideways chop ahead. The 200day will likely provide some support for SPY, but it’s just going to be sloppy for a while, back into my previously defined range of 360-410.

10yr…heading back to 4%.

On a positive note, Spring Training games start today! I cannot wait to hear that first crack of the bat, which lets me know that regardless of what markets are up to (or down to), the boys of summer are back.

Speaking of summer, I have a feeling a future post will be called “Sideways Summer”. The inflation fight is clearly not over and as long as that remains the case, markets will muddle along in search of direction.

My direction…will be straight to the back deck with the MLB app. I need a palm tree.