Anytime you casually glance over at Bloomberg and see Biden speaking on UFO’s… you know it’s been quite a week…

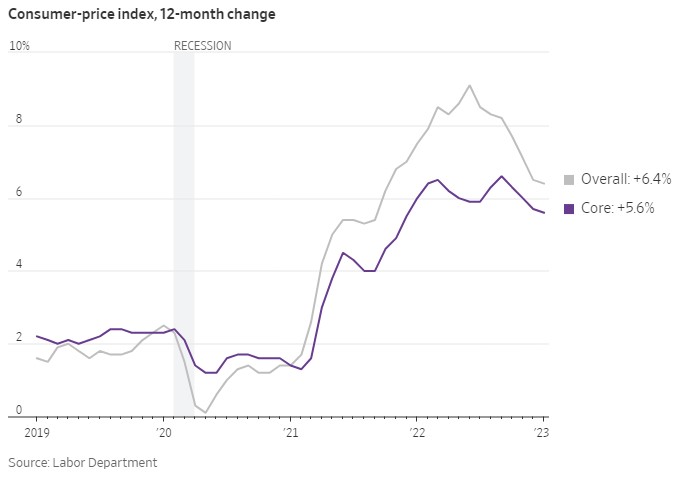

We got reads on both CPI and PPI, both came in hotter than expected and as I mentioned in an earlier post, the “pace” of decline will be the hot topic (and it already has). A keen eye on both charts will reveal a slower rate of descent and ~possibility~ we may start to level off.

I say possibility because I have no idea, neither does anyone else. A quote in The Journal this week hit it perfectly: “The only reason economists exist is to make meteorologists feel better.”

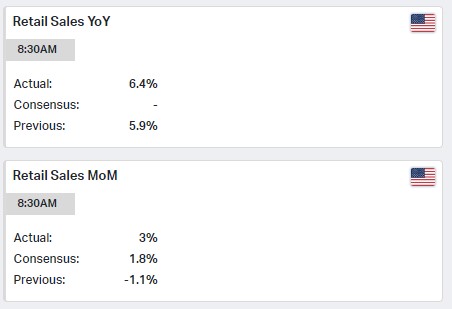

Retail sales figure was the biggest shocker, coming in at 3% MoM vs. a negative print in December. A similar beat for YoY at 6.4%. No doubt people are still spending, regardless of prices.

Which leads to another more ominous headline crossing yesterday, that US consumers now are the proud owners of $1 Trillion in credit card debt. Which begs the question, is the spending sustainable? Healthy?

The other stat catching my eye this week was the rapid repricing in bond yields. The 1 yr is now over 5% and the 10yr not far behind and (almost) back to the recent December highs. I will be honest, not sure I ever thought I would see a 1 yr yield over 5% again. Saver’s rejoice.

The reset on the 10yr will eventually manifest itself in higher mortgage rates again, which had enjoyed a little bit of recent reprieve. It will be interesting to see how the housing market shakes out the remainder of this year especially if these rates stay higher for longer. The Affordability Equation is firmly back in play.

Earnings for the most part are holding up. DE is out this morning with a beat and raise. CSCO, CDNS, RBLX, TTD, ROKU all beat and gapped up previously this week. Meanwhile some legacy names like SHOP disappointed.

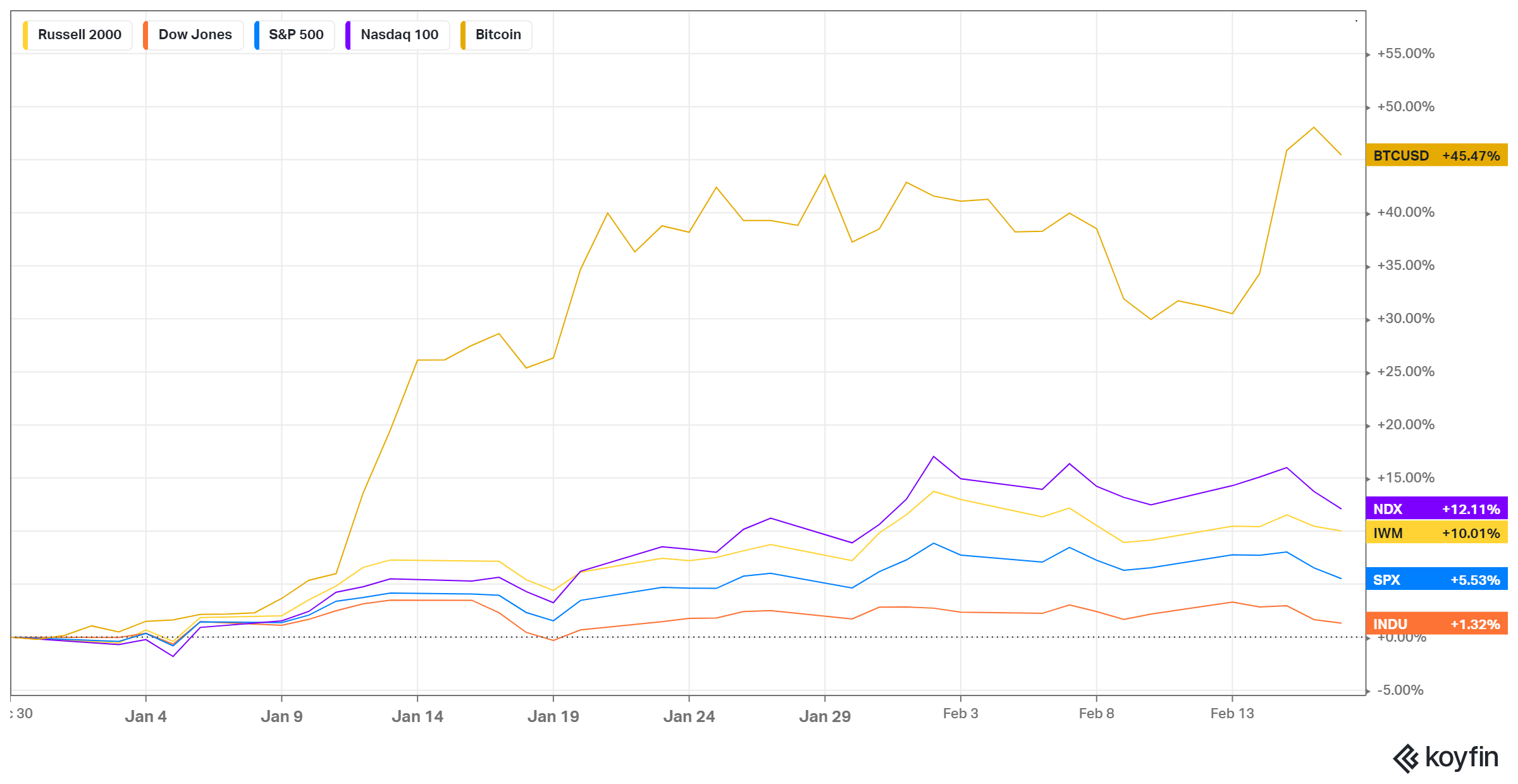

Markets took all of the above remarkably in stride until the late day sell off in yesterday’s session. It wasn’t until then that the VIX climbed back above 20 and the SPY dropped back below the 410 level I am closely watching.

We appear to be entering the long weekend on the back foot, but to be honest it still felt orderly in the face of the inflation data, hawkish rhetoric and yield resets. I see talk this morning of three more rate hikes instead of two, and of course the 50bps debate for the next meeting in March is back on the table.

Don’t look now, but Bitcoin is up almost 46% YTD. Never mind the increasing talk of regulation. Animal Spirits are alive and well.

Lastly, from a technical standpoint, the chart for SPY is pointing to more downside. I monitor the 5 and 20 day EMA’s for buy/sell trends (5 crossing 20 on the way up = buy, 5 crossing the 20 on the way down = sell).

We haven’t crossed over yet, but barring a stick save next week and large reversal, the long awaited equity breather may be upon us. Everything is rolling over and the RSI is dipping under 50:

It appears the barrage of data this week is finally hitting home? There will be plenty of time to mull it over with markets closed Monday for President’s Day.

Until next week…