I will be the first to admit that when it comes to patience, I am lacking. I can also proudly say I am improving. Or maybe I’m just getting older.

Where my impatience manifests itself most frequently is also where it can be the most problematic: in my trading and investing.

I have a tendency to “pounce” on a new idea or a stock that is trading lower than my original entry. Logical self would always quietly say in the back of my mind “if you liked it there, then you should like it even more here, and you better act now because it may be more expensive tomorrow!”.

I suppose one reason for my impatience is that the market in general just moves faster now than it did a decade or two ago. News is instant. High frequency trading algorithms are now in control. Stocks can move 20%+ in a single minute after hours and leave normal investors who check in the next day in total disbelief.

Brooks was right and I can relate.

I am totally fine with that though, because the faster it moves around me, the more I appreciate my ability to engage when I want to engage…ignore when I want to ignore!

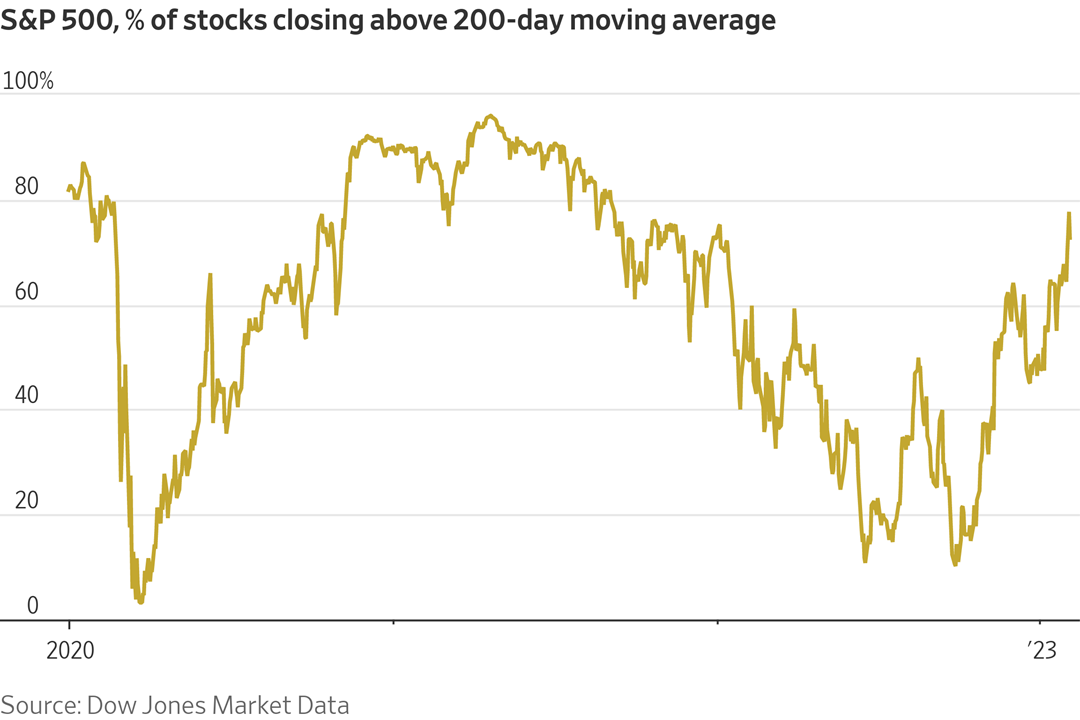

This WSJ graphic caught my eye today and speaks to the nature and breadth of the quick market reversal:

From what I assume from above to be the October lows of 2022 where under 20% were trading above their 200-day, that number is now approaching 80%.

Here is another way to look at it in terms of YTD returns. Below is the finviz heat map of the S&P 500 YTD:

META: +57.26% TSLA: +57.08% GOOGL: +18.82% AMZN: +18.54% AAPL: +17.8%

Wells Fargo: 16.04% Wells Fargo! A bank older than dirt that has more outstanding issues than People magazine is up 16% in a month?

My point is this. These moves are massive and they occurred during the first 29 trading days of the year. Suppose you are in a larger percentage of cash exiting the turmoil last year…after seeing these moves your first instinct might be “All In”. “Let’s go NOW because if we don’t, we will miss it all”. FOMO takes over.

The older and wiser (and also more patient) version of me realizes just how much influence psychology has on investment decisions. Animal spirits just simply take over.

Some things to keep in mind:

Savers can now be rewarded. The yield on the 2 year note (a good proxy for Fed Funds) as I write this is at 4.475%. Two years ago it was 0.105%. A 4100% change. For the first time, in a very long time, you can earn a decent yield risk free in money market funds and on-line savings accounts. It now truly does pay to do nothing.

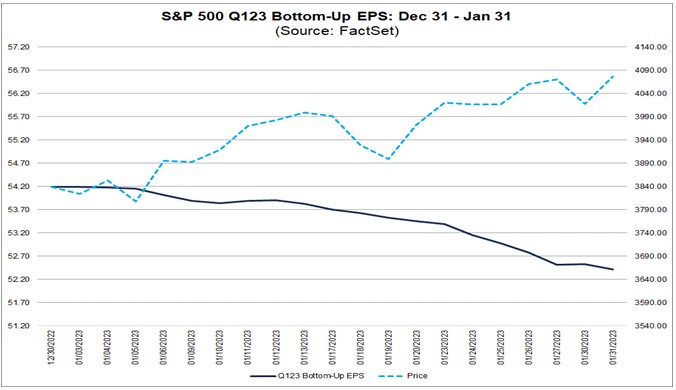

The market and earnings are diverging. Earnings historically drive prices but that has not been the case to start 2023. While the market has rallied, Q1 EPS estimates for the S&P 500 were reduced by over 3% which is very atypical. Many will argue forward EPS estimates have further to fall and that is not currently being priced in. What is being priced in are rate cuts in the latter half of 2023 🤔?

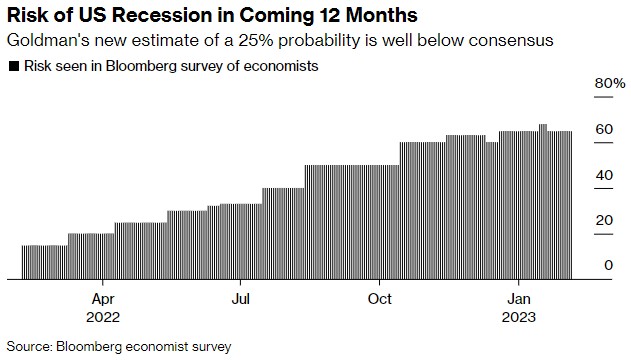

Inflation and higher rates may stick around longer than we think. The target inflation rate is still 2% which suddenly seems light years away from recent readings. If the economy manages to stay relatively healthy and demand stabilizes, inflation may not retreat as quickly as the Fed would like. Goldman has recently reduced a recession probability to 25%. An outlying opinion perhaps, but one that does further support the “higher for longer” narrative.

While I was working on this post, the Fed Chair was being interviewed by Carlyle Group Co-Founder and Bloomberg contributor David Rubenstein in Washington. I overhead Powell mention something along the lines of “we are just at the beginning of this process and this is all going to take some time…”

When you look at the market reaction during the interview, I think it sums up very well where we truly are in this process. Nobody knows!

How the rates, earnings, recession probability, employment and 10 other things I can’t immediately recall shake out is anyone’s guess.

One thing I do know. My moves, reactions and investment decisions will continue to be much more measured in 2023.

Patience Always Wins.