The 25 bps increase in the Fed Funds rate announced today was very well telegraphed and fully expected. The announcement itself has little impact these days, now it’s all about the presser.

I mentioned in an earlier post the market would be looking for any type of dovish tilt. To be honest I thought Powell used his typical hawkish slant, perhaps it is becoming stale and the words just don’t carry the weight they used to…

Here is the release in its entirety for those interested.

A few hawkish excerpts from this doc and the presser, some we have heard before:

“…..anticipates that ongoing increases will be appropriate…..”

“…..the job is not fully done…..”

“…..We’re going to be cautious about declaring victory and sending signals that we think the game is won…..”

“…..Certainty is just not appropriate here…..”

“…..Inflation has eased somewhat but remains elevated…..”

“…..strongly committed to returning inflation to its 2 percent objective…..”

Sounds relatively hawkish to me. Also sounds a bit ~tired~ and I think the market decided to look past it and hang its hat on one sentence:

We can now say for the first time, the disinflationary process has begun…

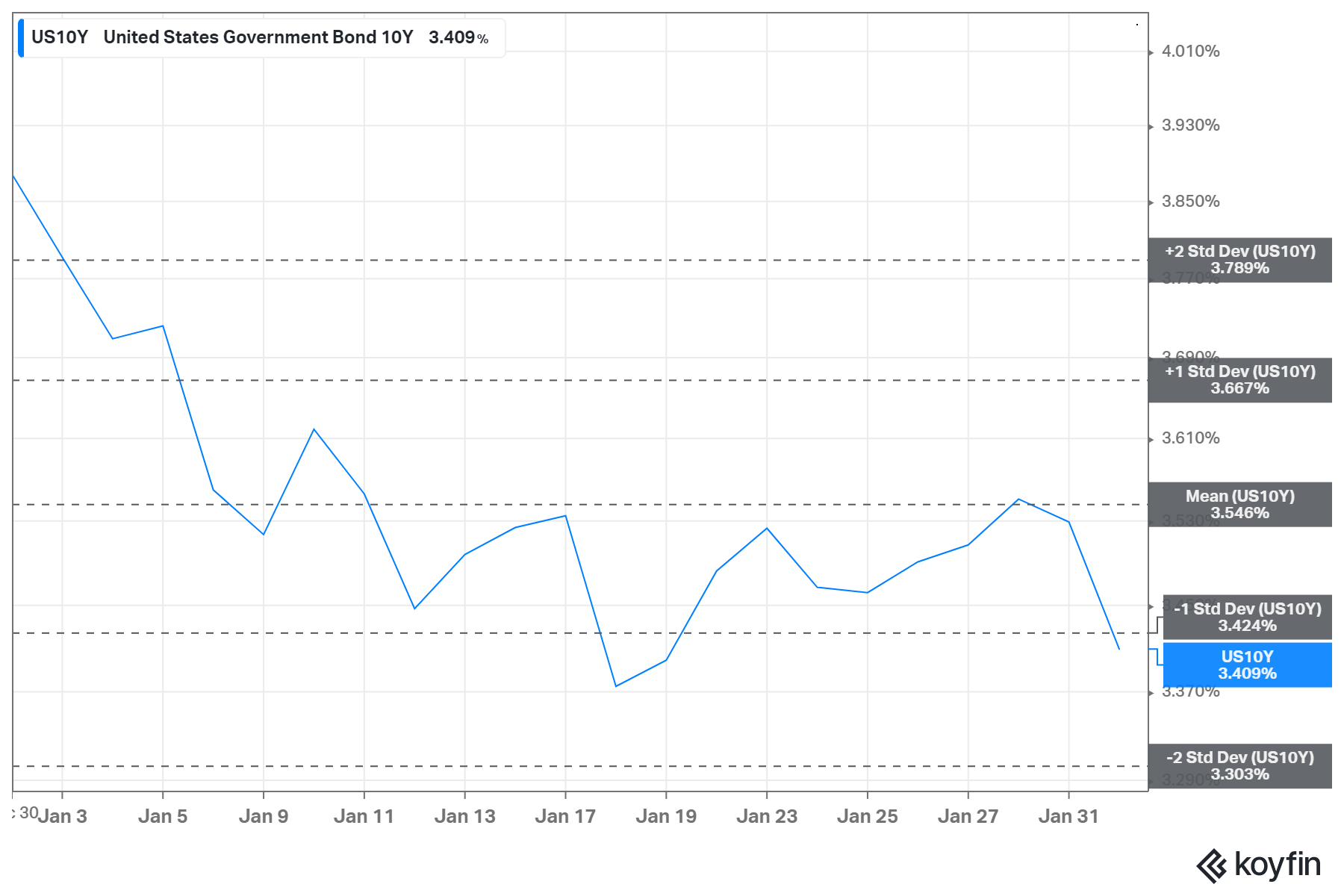

The rest is history. Bonds rallied fiercely sending the 2 yr yield to almost 4% and the 10 yr yield to 3.409%.

SPY ran past 410 to close at 410.80 and briefly touched 413.67. My “Range Bound” theory of 360-410 is already being tested on the first day of February! (Note the RSI has poked above the down channel also)

Will be very interesting to see if we can hold here with more data and earnings on tap.

For now at least, Mr. Market heard what it wanted to hear, or perhaps what it chose to hear on FOMC day.