Things got interesting early Tuesday when a trading glitch on the NYSE sent some opening prices on a wild ride. I wasn’t at my desk for the open but I noticed some odd candlesticks on a few names on my watchlist when I did plug in.

As it turns out, an employee at the NYSE backup center in Chicago “left the backup system running” into the opening bell. Chaos ensued affecting about 250 securities sending many on 25% swings. I am glad I missed it, I don’t like 9:31am surprises.

Microsoft after the bell Tuesday was the classic rug pull. An after-hours whipsaw sent shares higher by 10+ pts only to give it all back and more once forward guidance became clearer on the call.

By the end of day Thursday it had recovered once again and after good news from Tesla, all of large cap was marching higher.

Let’s be honest at this point the future guidance is all that really matters. We know 100K+ job cuts (and counting) have been announced, we know growth is slowing, we now need to hear from each company what they see in the second half into year end as the market is already trying to price that in.

Freeport-McMoRan missed due to lower copper prices and guided sales pretty much flat in 2023. They did however shine the light on an increase in expected future demand outstripping supply and mining capacity going forward. EV’s use a lot of copper.

When you zoom out to a weekly view of FCX, they are testing that 45 area from mid 2021, next stop if that holds will be testing 50 that proved to be the top early last year.

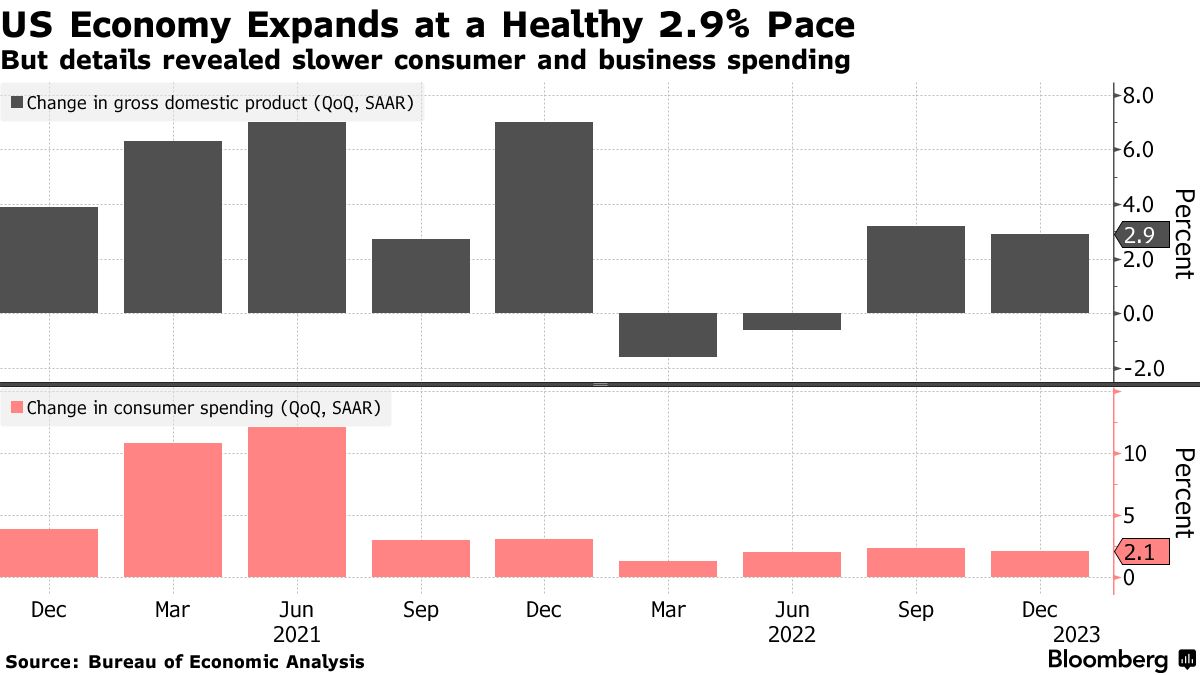

The Q4 read on GDP was no doubt the most anticipated print of the week and it came in at 2.9% a little above the 2.6% consensus and below the 3.2% from Q3. Once again, more evidence things are cooling (lower inflation) without collapsing (the R word). Consumer spending rose 2.1% a tad slower than the prior 2.3% rate.

No doubt consumers are still feeling the pinch as anyone who has bought groceries lately will attest to (🐔 EGGS!).

New home sales were higher at 2.3% vs. 0.7% the prior month as mortgage rates eased.

Numbers from Intel after bell Thursday left little to be desired, not worth getting into specifics everything was down and everything was lower. Am I the only one that still uses an Intel powered laptop? Am I the only one with Intel inside? Looks it…

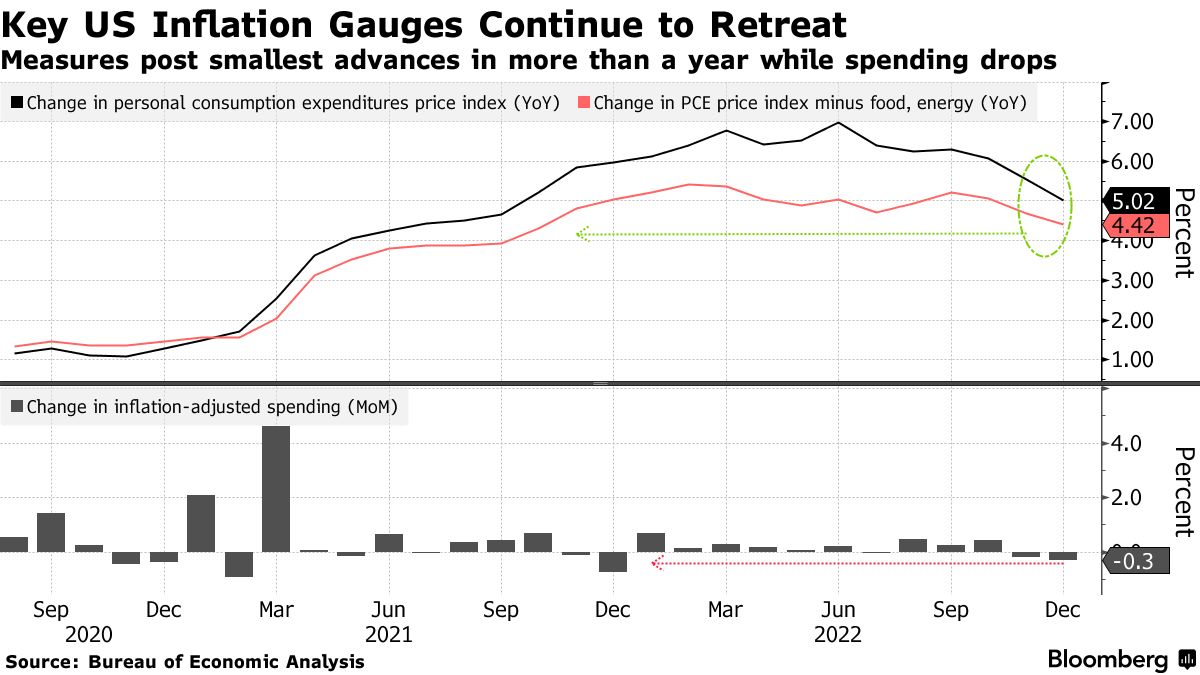

This morning the Fed watched Core PCE Price Index numbers were spot on expected at 4.4% annualized in December vs. the 4.7% read in November. The month over month numbers were 0.3% vs. 0.2% in November. Bottom line – no shockers – no surprises – prior to next week’s meeting.

Some other takeaways for me on the report was savings rate up to 3.4% in December, the biggest increase since July 2021 and discretionary spending across the board was down. Prep for what (may) lie ahead perhaps?

Chevron was out Friday morning and they killed it earning 6.4B on revenue of 246.3B. They previously announced a 75B stock repurchase plan and dividend hike. Oil is off a third from last year’s peak and they still delivered strong results. Energy may continue to lead the way this year.

So I guess to wrap, earnings was kind of a mixed bag this week with no outliers from the Econ data, so we appear to be headed for another 25bps hike next week. The market is flat as I type this perhaps trying to digest it all as am I.

On the lighter side, if your wallet happens to be just as equally as heavy, maybe you can be 18 again.

Enjoy the weekend.