Tuesday

MSFT earnings. After joining the remainder of tech with painful job cuts, they will be the first large firm to provide an idea of 1) just how bad it is and 2) give some insight on whether they can provide any meaningful forward guidance this early in the process.

Wednesday

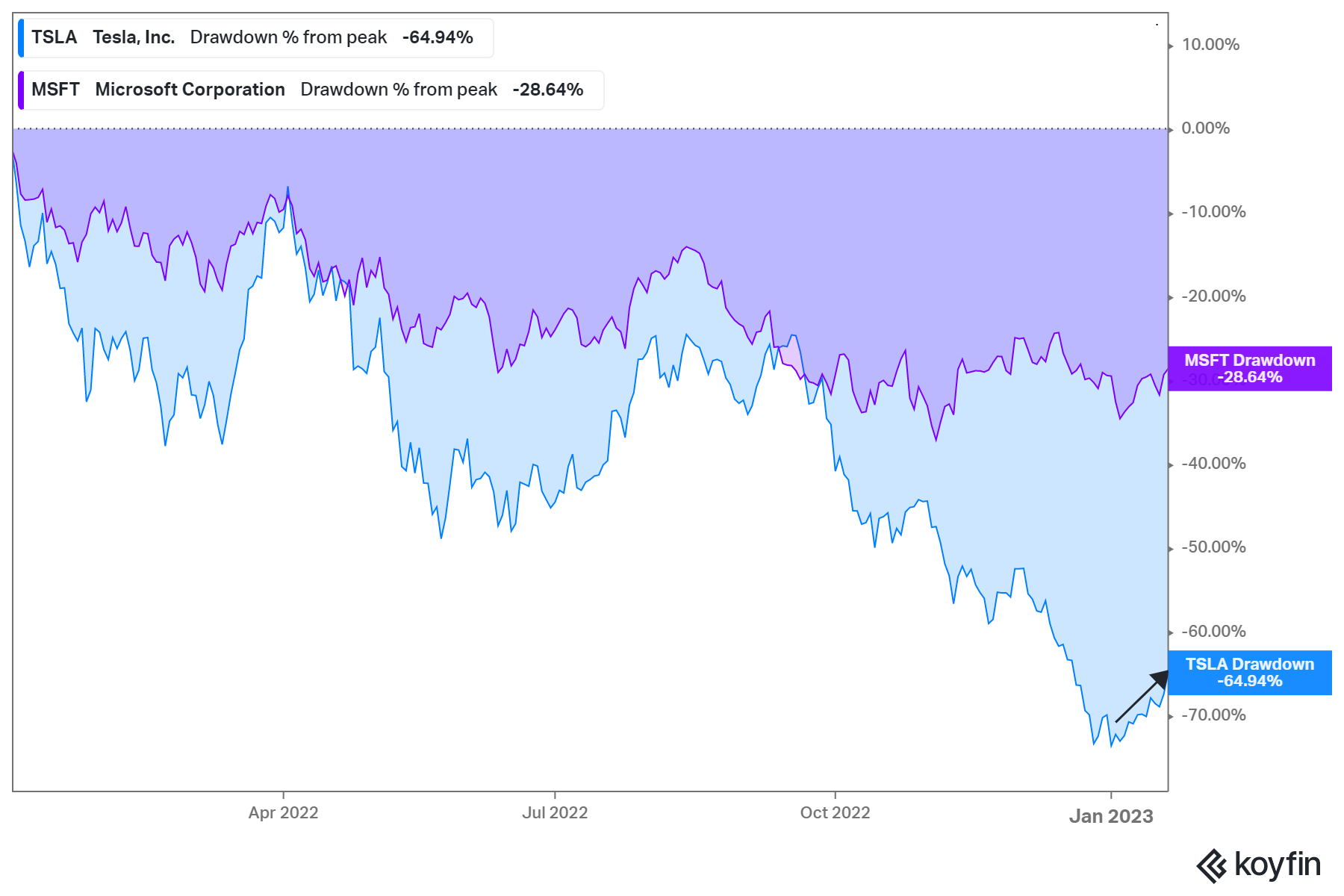

TSLA earnings. Reatail investors have a newfound thirst for the shares it would appear. They have turned up from a 70%+ drawdown since the start of last year. Could be short lived, we will see. Microsoft is added below also for comparison.

FCX Earnings: Freeport-McMoRan will not get the same attention as the two tech giants but it is a good proxy for the overall economy and is a very forward looking name. Copper has been a tear recently and Freeport is clearly pricing in sustained demand going forward. A lot of chatter about a new commodity super cycle emerging due to supply constraints also. You can see below how it has diverged to the upside from the flatter broader market of late. Will be worth listening to what they have to say.

Thursday

Key economic reads galore all hitting the wire at 8:30. Q4 GDP will get all the headlines and will likely have the futures dancing around prior to the open. Any upside surprises here could put a fork in this recent rally for sure, I don’t think anyone is pricing that in.

Add in durable goods, inventories, new home sales, jobless claims? Going to be a busy day for the tape.

I would also include earnings from V and MA to that list simply because they provide some further insight into spending and more importantly the resiliency of that recent spend. You will get Mastercard before the bell and Visa after the close.

Friday

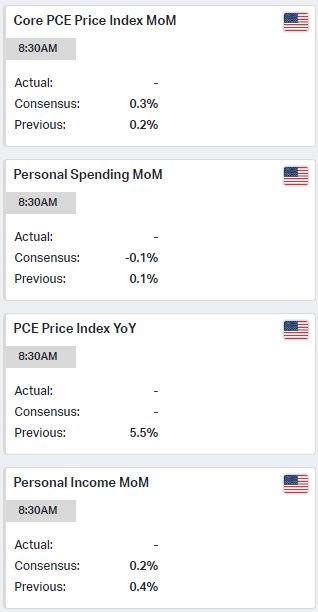

More econ numbers including the Fed preferred PCE-pricing index on tap along with personal spending and income.

University of Michigan Consumer Sentiment is also out which speaks for itself and Pending Home Sales to get a read into how traumatic the mortgage rate increases have been.

Oh, and the Fed is scheduled to meet next week to solidify yet another rate hike, albeit a smaller one at just 25bps this time around. We hope.

Let’s get to it.