Going to switch gears this weekend to some good news.

Yes, I said good news!

I am not going to further lament the death of the 60/40 portfolio, mainstream media outlets have done a very fine job there. Not going to talk about the most highly anticipated and predicted recession in modern times.

Let’s talk about a long standing negative that has finally turned positive…

Pensions.

If you happen to be fortunate enough to still have one coming to you for private sector work (disclosure: I do) the recent history has not been kind. Do terms like “underfunded”, “insolvent” and the well permeated “frozen” sound familiar?

Whether it was taking on excess risk due to poor management or the impact of low interest rates on funding requirements, private sector pensions have been on shaky ground for quite some time. I won’t even attempt to talk about the public sector.

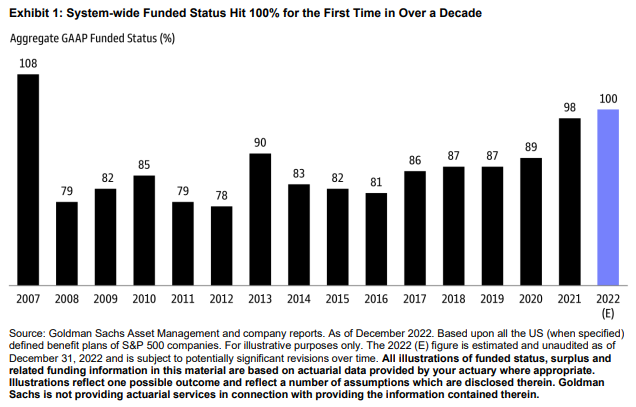

A piece out by Goldman this week is a welcome bit of good news. According to the memo, corporate defined benefit pensions are in the best shape in 15 years with funding at 100% for the first time since the GFC in 2008.

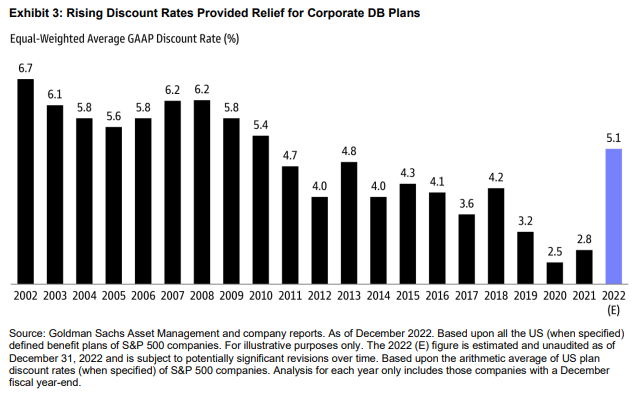

Good news didn’t stop there. Discount rates are now above 5%, a stark reversal to the “low rates forever” environment of recent years.

Discount rates are a big deal simply because the lower the rate, the more companies must pony up to meet accounting “mark to market” requirements. In other words the less pensions are expected to earn going forward, the more they need to be valued at or funded today. With discount rates now over 5%, companies will be able use that higher rate to determine their funding requirements.

I recall my former employer taking large hits in Q4 year after year after year just to meet the accounting requirements for the pension obligations. It would appear that era is over and will be a welcome relief for companies saddled with those obligations.

For employees expecting pensions that is good news indeed.

For employees, both former and present, who may be facing pension buyout offers going forward, they can expect much smaller lump sum offers. The present value calculation of the pension will be much lower when using a higher discount rate. This may lead more companies to also try to offload those obligations and pay the lower lump sum now vs. doling out the monthly payment for life.

Lastly, let’s not forget market returns lately. The pension fund itself is only as good as the sum of its components and where that capital has been deployed. Even bonds were not spared in 2022, much less higher risk assets, so if overall values took a dive that may require some additional contributions and offset some of the benefits from higher discount rates.

All in all, I view the report as positive. The math just got a little easier.

Anything to help solidify the certainty and status of future pension payments for those fortunate enough to be on the receiving end is a good thing.

You can read Goldman’s memo in its entirety here.