Any lingering worries of an overheated economy got a fresh set of fingerprints today that showed evidence otherwise.

It was really across the board, and bonds continued their recent rally sending yields lower now falling beneath 3.4% on the 10yr as I write this:

Here is a brief summary of (some of) the data released today:

| November | Consensus | December | |

| Retail Sales MoM | -1.0% | -0.8% | -1.1% |

| PPI MoM | 0.2% | -0.1% | -0.5% |

| PPI YoY | 7.3% | 6.8% | 6.2% |

| Core PPI YoY | 6.2% | 5.7% | 5.5% |

Manufacturing numbers retracted also. So yes if you are the Fed you are seeing what you wanted to see, lower prices and reduced spending which should translate into lower inflation.

Keep in mind this was December also, which typically would bode well for retail sales.

The question now will become have things slowed too much and risk tipping into the R word, some will argue that may be the case and I already see articles suggesting it is already here.

I am still in the wait and see camp and each month will – hopefully – bring more clarity.

Markets have been pinned down all day and the S&P has dipped back below the key 200 day. Not entirely surprising and as I stated earlier in Range Bound, this is going to be a sideways grind for a while.

Microsoft has joined the axe party and will layoff 10K workers this quarter, recall it was Amazon trimming earlier to the tune of 18K. I think at this point C-suites have decided to just rip off the band-aid as opposed to the slow peel, they need expenses down yesterday.

Bloomberg has a summary out today of all companies planning cuts to date. The list is long and growing.

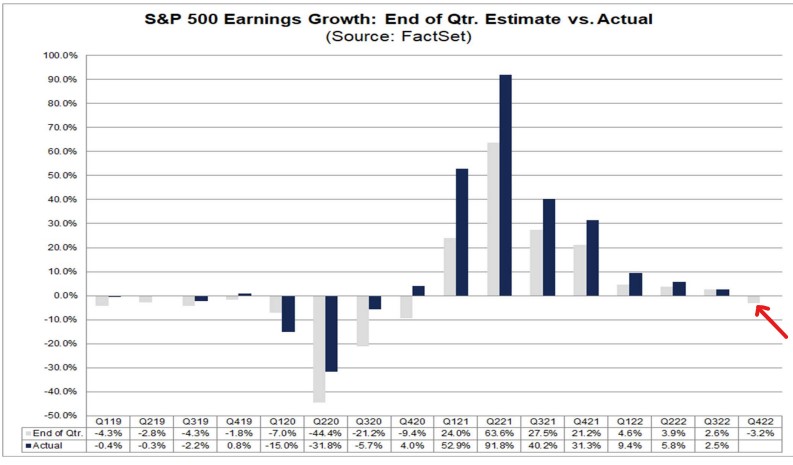

So at this point we shift back to Q4 earnings and parse the forward guidance to death for any signs of stabilization.

Anyone see any sun? Literally or figuratively?

Overall Q4 EPS are expected to fall and any “big beats” will be extremely rare. I will be watching the consumer related names but again I think it’s the guidance – or lack thereof – that will move markets.

In other words, get comfortable. It may be a while.