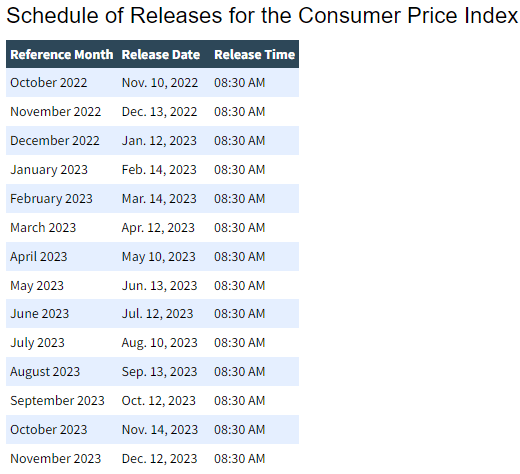

The CPI release dates will probably continue to be the most anticipated nugget of economic data this year. Here is the schedule:

Skies continued to clear a bit today as the December release came in at 6.5% vs. the 7.1% print for November. It dropped back below the +2 std dev vs. the 10 year mean which was good to see. A view of the CPI vs. the Fed Funds Rate shows the two inching ever so closer:

That chart amazes me every time I look at it, you can see exactly just how behind the curve The Fed was last year and this rapid hike cycle still has room to go higher. I see JPM’s Dimon now is thinking as high as 6% before things are under control.

Time will tell, but the gap is clearly closing.

As for Market reaction I would expect it to rally on that print, but my Range Bound thesis remains. There are some stiff overhead resistance levels at the 200dma (~397.50) that will be tough to crack. Beyond that if it can get past 401, the top of the down channel is next and ultimately 410 is in play.

Volatility in terms of the VIX is non-existent right now, I see it has already dipped below 20 this morning. I think that speaks to just how sidelined we still remain (in cash).

I usually scale back risk when we get below 20 (the lower bound of the 20-28-36 range I watch).

Bonds are catching a bid today and the 10yr yield is flirting with 3.5 again, good news for mortgage seekers, any continued relief here will bring those rates down as well.

Attention can now turn to bank earnings to see if any type of rally can be sustained.

Those kick off tomorrow morning and with a tamer inflation print, Q4 earnings will now take center stage.

Everyone is trying to get a feel for forward earnings revisions and that picture too should be a little clearer this time tomorrow.