Rates suddenly matter.

I can remember in the not so distant past I was beginning to wonder if they would ever matter again. After a brief rise followed by Powell’s famous “far from neutral” mention and the far from agreeable market reaction exiting 2018, it wasn’t long before they were headed back down in 2019.

Enter a global pandemic a few months later and the rest is history. We were right back to zero until last year.

When I first started shopping for a home in the mid 90’s I remember a 30yr mortgage was about 8.5%. I did the math on what I could afford and I did not like what I could afford!

So either my pay went up or rates came down, I was not going to be house poor at 25 and stop investing.

When mortgage rates dipped below 3%, refinancing ‘en masse’ occurred and it was really too good to be true. I was a little early and locked in around 3.75%, but I knew the history and knew 3.75% would still look very very good someday. Someday is today.

The trajectory of rates in 2022, the velocity, whatever you want to call it was staggering. Knowing that mortgage rates track the 10yr yield, in the back of my mind I knew many soon to be – or striving to be – first time homeowners would be priced out.

The affordability equation takes on a whole new persona in a rising rate environment.

Let’s go back in time and run a little experiment using some data from last year.

Lucky Couple #1 needs a new home. They are able to find one and lock in the lowest rates of the year.

Not So Lucky Couple #2 also needs a new home. They too are able to find one, but it took much longer and they are faced with the highest rates of the year.

For this exercise we will use the November median US home price of $471,200:

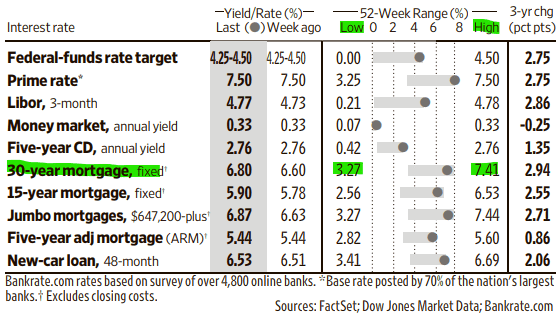

We will use the range of 30yr mortgage rates outlined in the year ending issue of the WSJ:

Let’s assume both couples are able to put 20% down (rounded up to $95,000) and for simplicity we will use the default escrow (property tax and insurance) amount provided by the Bankrate mortgage calculator for my own personal zip code:

Lucky Couple #1

$376,200 financed @ 30yrs @ 3.27% = $ 1,644 + escrow = $2,017 per month

Not So Lucky Couple #2

$376,2000 financed @ 30yrs @ 7.41% = $2,612 + escrow = $2,983 per month

It pays to be lucky. To the tune of a $966 lower house payment…

Can both couples still “afford” the same house with the drastically different rates?

Let’s find out, assuming we want to stay at 28% housing debt to gross income per the 28/36 rule1.

Lucky Couple #1 would need a combined salary of $86,448 ($2,017 / 28% = $7,204/mo. x 12)

Not So Lucky Couple #2 would need a combined salary of $127,848 ($2,983 / 28% =$10,654/mo. x 12)

Couple #2 needs to earn at least 42K per year more than Couple #1 to qualify for the same loan just because of their timing and the rate increase.

Let’s assume both couples actually earn the lower combined salary of $86,448. Due to the higher rates, what is new maximum home price couple #2 would qualify for?

We will assume they are still going to put the full $95,000 down, just as they planned to do before.

If we use the 7.41% interest rate, with $95,000 down and cap the mortgage payment at $2,017/mo., the maximum home price Not So Lucky Couple #2 can now afford is $344,000 ($127,200 less than Lucky Couple #1 even though they earn the exact same)2.

So in essence Not So Lucky Couple #2 is forced to put 27.5% down on a much lower priced home just to keep the mortgage payment the same due to the higher rates!

“Sorry honey, either we scrounge up another $128K or we look for a different neighborhood.”

Keep in mind also this APR ascension didn’t happen over a matter of years, it happened over a matter of months. I feel for those blindsided by this, it is a brutal reckoning.

I went through that exercise just to help show the sheer magnitude of the tectonic shift currently underway in housing. You cannot double mortgage rates in less than a year without serious consequences. Either the home prices fall due to reduced demand, or rates fall allowing sidelined buyers to re-enter the market.

Key word here is demand, what the Fed is mercilessly fighting right now is demand in general, across the entire spectrum of the economy, attempting to bring inflation down.

When the mortgage rates ease is anyone’s guess, perhaps home prices blink first and there are signs they have already started to do so. If you are in the market for a home, get to know the 10yr treasury yield and watch it closely, your rate will move as it moves.

I fear many will be operating with very little margin for error and even less margin for investments and their future due to a reluctance to compromise in the present.

In other words, this environment is ripe for overstretching.

Listen to the ratios and never let a lender tell you what you can afford. Only you can decide that because only you have sight of the bigger picture and how the house ultimately fits into it.

I rented for years until I felt like I could purchase my second home first, and on my terms, not the lenders. The numbers simply didn’t work for me at the time but they eventually fell in line and I was ready to act very quickly.

Leave some margin, because some breathing room priced into tomorrow is always a good thing.

1 The 28/36 rule is a long standing rule of thumb used by lenders and financial planners. Total monthly housing debt payment (i.e. mortgage) should not exceed 28% of your gross monthly income. Total monthly debt payment (housing, car, credit, etc) should not exceed 36% of your gross monthly income. Good credit has been known to stretch %’s in your favor but that also highlights the importance of overall planning. Just because the ratio works doesn’t mean it is truly “affordable”. Capeesh?

2 Several ways to do it, I just used the Bankrate mortgage calculator and kept lowering my amount financed at the higher rate until I dropped below my max payment amount.