It’s a love hate relationship for me and the behemoth.

For years in my former job they were the bane of our existence and a constant cause of angst. Anyone with a background in the transportation industry will likely relate.

However, if I try to picture my personal life without the smiling box, I struggle.

Ask someone you know to put down their smartphone for a week. They would faint. Ask that same person to not order anything from Amazon for I don’t know, say 3 months. Granted they may stay conscious, but I assure you they will not be happy.

Just as Apple has become fully and forever entrenched in our lives (all but mine), Amazon has followed in lock step. That is by design and that is their intention.

If I need something – if I need anything – I check there first. Home improvement needs are the only exception where I prefer to casually stroll through my neighborhood Lowe’s in the afternoon.

I pay my annual Prime fees sight unseen. Did it go up? I have no idea, don’t care, it’s the cost of admission. You get the idea, they are here to stay.

When they announced the massive job cuts last November (10K), it wasn’t unexpected because other companies were doing the same. Now in 2023, a memo to employees announced that cut has been expanded up to 18K. You can read the entire memo here.

CEO Andy Jassy sat down with CNBC’s Andrew Ross Sorkin in late November at the Deal Book Summit. Some of the statistics Jassy shared were staggering 1.

In his own words:

…A lot has happened in the last few years that I’m not sure people anticipated. If you just look in 2020, our retail business grew 39% year-over-year at a $245 billion annual run rate, which is unprecedented. And it forced us to make decisions in that time to spend a lot more money and to go much faster in building infrastructure than we ever imagined we would. We’ve built a physical fulfillment center footprint over 25 years that we doubled in 24 months.

They obviously were reacting to what they felt was permanent, not a fad.

He went on to say they had reviewed 50-60 operating plans over the previous 4 months to get a feel for adjustments needed going forward.

And our goal really in how we’ve gone through the operating plan has been to very thoughtfully but thoroughly go through the plans and make sure that where we can, we streamline or cut costs, but at the same time, we don’t compromise on the key strategic long-term bets that we think can change the company. And that’s how we’ve tried to view these operating plans.

One might argue the FC (fulfillment center) buildout may have been over the top but he feels they will eventually grow into it. Hard to disagree there. On the people side, he made it clear they expanded aggressively there too, based on the trends, which in hindsight was perhaps too aggressive.

So here we are.

With that backdrop, in terms of a trade or an investment going forward my key takeaway is that the consumer (you, me) is not going away. AWS customers and the high margins are not going away.

What the S-team has at their disposal (I cringe typing “S-team”, I still picture Bezos, red cape) is a plethora of levers which to pull to increase profitability to the bottom line. Sales may soften and “flatten” some if you will, but they will remain. People will still spend.

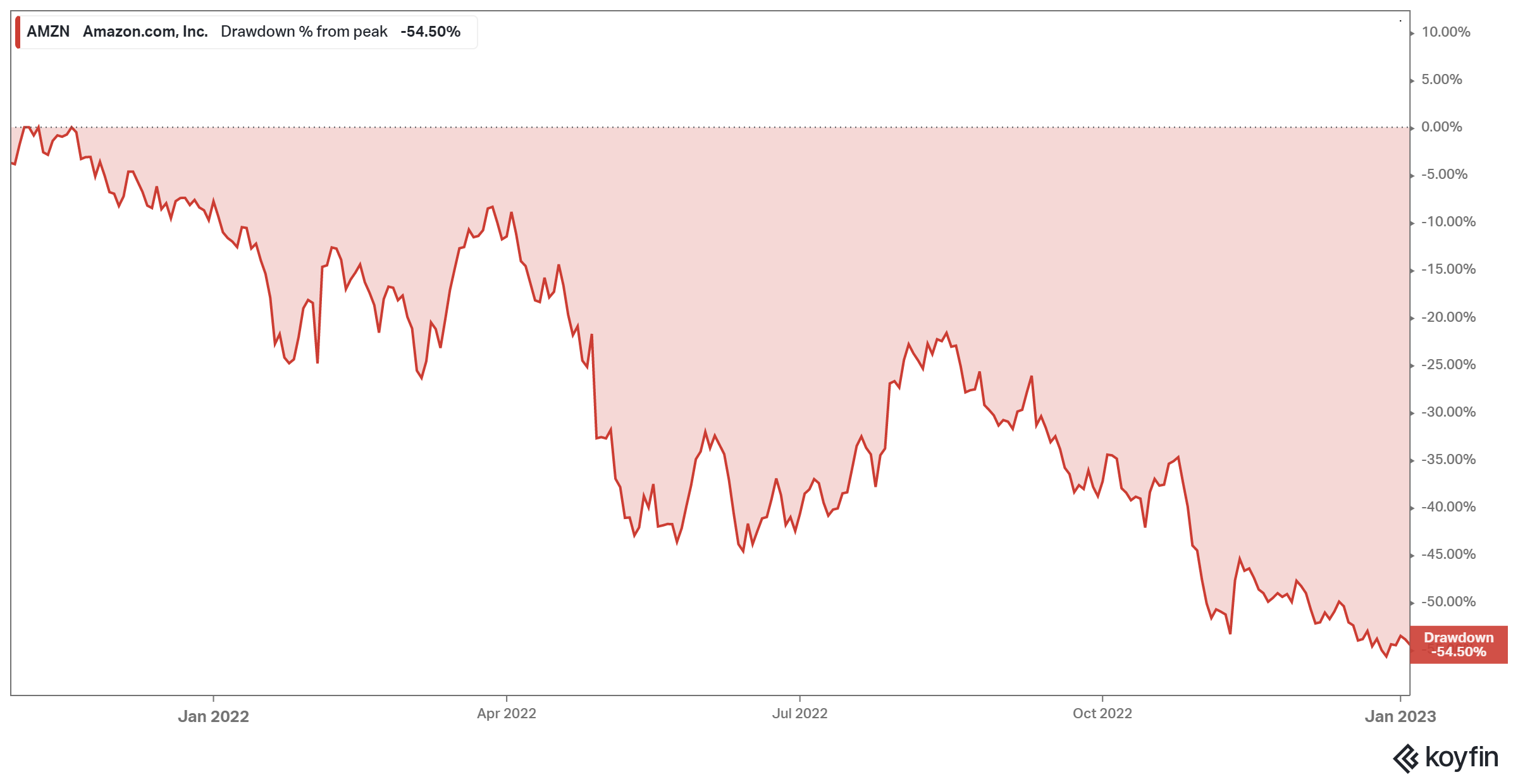

Let’s talk about the stock. Along with the rest of tech it was shellacked in 2022. Rewind back to November ’21 when the selloffs began in earnest and as of today, the drawdown is 55%. Cut in half.

note: all charts or graphics used in posts are also available via Charts on main menu

Relative Strength has continually weakened and all attempts to rally have stalled at the 20 day ema, (7) times in all since last September.

Stocks track earnings (it’s a fact, just ask WB, not me – Warren Buffett) and if you overlay AMZN’s price against the next twelve month EPS estimates, it tracks in lockstep. Note that recently the downward estimates have stalled but the price has continued to fall.

Sales estimates have come off as well, but you can see they remain “stable” when compared to the stock’s repricing. Safe to say, sales are important but not what the street is watching? Earnings matter in 2023+.

In terms of value, and yes value is important these days, sales are still a good measure when compared to historical valuations.

I will end with this chart, which I am starting to create for many beaten down names.

Amazon has not traded at an EV/S (Enterprise Value to Sales) below 2 in almost 8 years. You will need to go back to 2014-2015 to find values that low.

The stickiness of inflation, steadiness of rate increases, likelihood of a recession will continue to drive the headlines and influence the overall market backdrop.

As for Amazon, the impact of the changes being made and levers being pulled will manifest quickly in 2023. How that translates into investment returns is anybody’s guess but they have not been this reasonably priced in some time.

They are not going away.

Neither am I and that reminds me, I am expecting an order tomorrow. My “Prime” delivery day is Friday.

Sources

1 Koyfin.com, AMZN – News, Filings & Transcripts, Deal Book Summit Nov 29 ’22

https://app.koyfin.com/news/ts/eq-h8ov0r/all/2701583?sourceType=transcript