Call it voodoo, a waste of time, adult crayons – I do pay attention to technical analysis and technical levels in the market. I do not trade or invest solely on it, but I do pay attention.

Perhaps it is in fact just self-fulfilling prophecy, but I think it matters and here’s why:

I am not the only one watching it.

There are many others.

I am not alone.

The following snip from a previous Bloomberg article depicted the December ’21 turn and the new down channel to hell we find ourselves in. Lower highs, lower lows, 50 day sma dragging along below the 200. Not good.

The great thing about technical analysis, is you can make it tell you what you want it to. It is the ultimate tool for confirmation bias! So I took out my own crayons and outlined in blue what I felt was the new channel.

The “Range Bound” sideways channel that should continue into 2023. For what it’s worth I outlined it first on November 11 and look – the top held perfectly. Confirmation?

The range you see depicted is basically 360-410 give or take. It smooths out the mid August highs and October lows. We would need to break back through those October lows before I abandon my sideways channel for the hell channel.

I do think it will take some concrete data, some outlier inflation prints, some (big) Q4 earnings misses, geopolitical escalation, basically something worth noting to break us free from this range.

I noticed today that all the support and resistance pivots I track on Fidelity Active Trader Pro had tightened up considerably around 380, very crowded in the middle of that range.

It will be interesting at what point in 2023, or dare I say…2024? that we break out. I didn’t say to the upside or downside because in my opinion at this point it’s a coin toss. Take your pick.

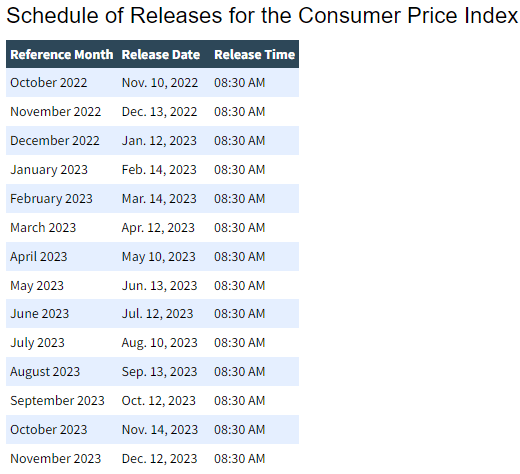

The data to be released according to the table below will help determine that direction:

In the meantime I will be monitoring where we are trading in the channel and see if any of the most beaten down names from ’22 can catch a bid.

If not, no big deal. I can wait.

The list is long and the coffee is strong.