Let’s rewind a moment to March 2020. The market retreat at the onset of the pandemic was while I wouldn’t say “unprecedented” it was indeed fierce. Emergency Fed meetings ensued and rates, which had just recently started to rise off the mat, were once again taken back to zero.

By mid August, the S&P had fully recovered its loss, but the world was just beginning what would be a truly arduous journey. Wave after wave, variant after variant. This I think we can fairly say, at least for this generation, was unprecedented.

Fueled by stimulus and low rates, markets never looked back. After breaching 219 in late March 2020, the SPY closed at 373.88 at the end of 2020 and 474.96 at the end of 2021. I remember the debate in 2020 about what shape the recovery would be and if the early rebound was just a head fake.

Call it what you want but the broader market 2x’d off the lows in less than 16 months. Smooth sailing, right?

Another storm was brewing as we ended 2021, yes there was another variant – but there was also another long forgotten nemesis rising.

Inflation.

When I hear the word I instantly see images of Jimmy Carter and lines of huge glimmering metallic beasts of automobiles waiting in line for gas. I was a kid then and too young to remember or experience that “pain” but it is very visible when you see how 70’s era inflation compares:

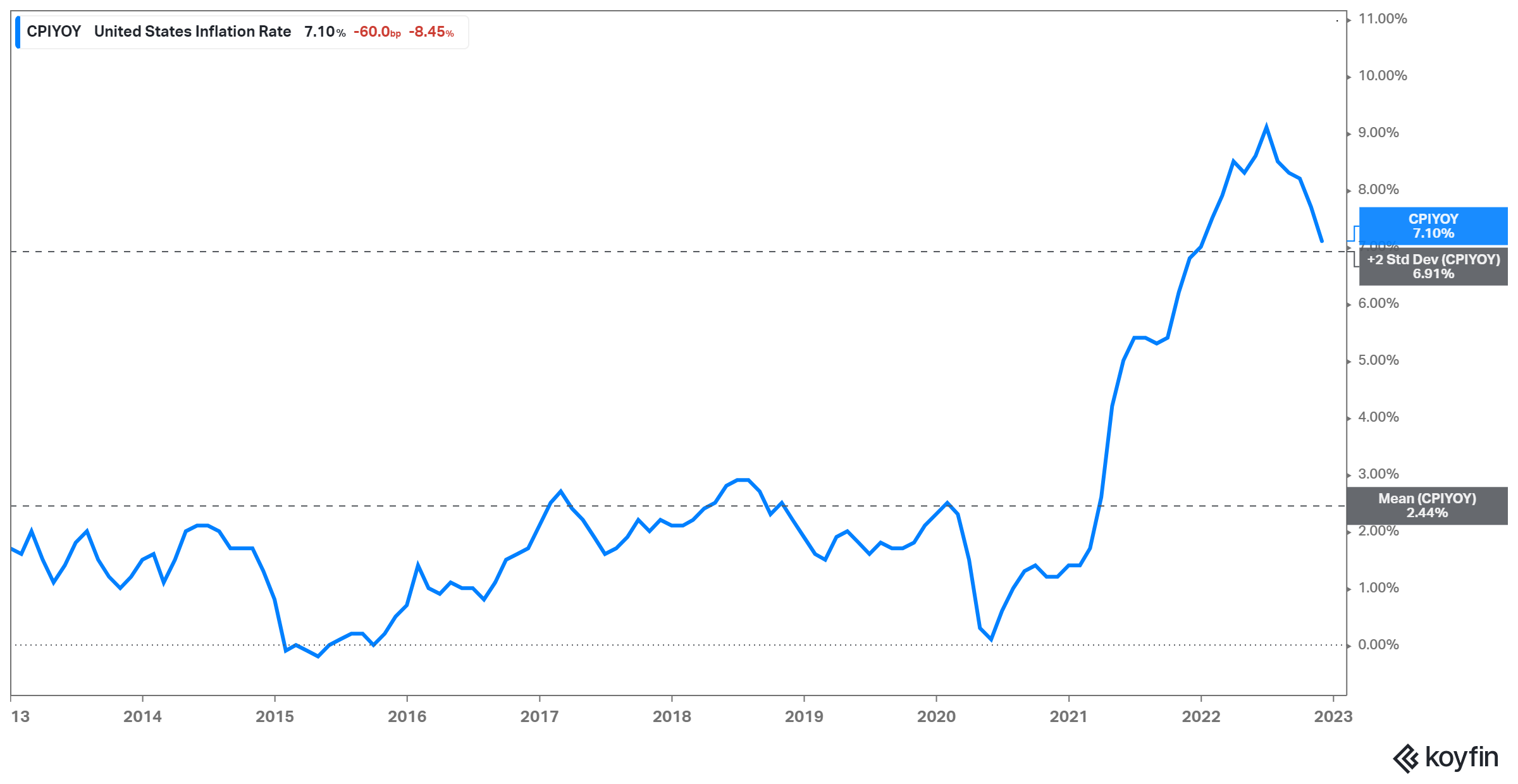

You have to go back to 2008 when the price of a barrel of oil doubled to $140/b from a year earlier to see inflation prints above 5%. Prior to that? Operation Desert Storm. But look at how long we hovered around 2% or even zero for that matter. That sharp increase at the end was just the beginning of the current cycle, we would end up close to that 10% level once again.

Good news the rate is starting to come down. Bad news it still sits a full 2 standard deviations above the 10 year mean and must continue to come down before the Fed stops raising rates. The street will be looking for any signs of even a pause at this point.

This particular hiking period has reminded me just how important it is to respect the current market cycle, whatever that is at the time, regardless of whether I agree or not.

At the end of 2021, the Fed was clearly signaling it was ready to get this number down at all costs. Transitory no more. Hikes were on the way.

When you look at a view of the SPY drawdown set against a backdrop of the hiking cycle, the message is painfully very clear what the hikes meant to markets. SPY peaked in 2022 on January 3rd (yes, the first trading of the year indicated by the black dotted line below).

Rates up, Market down.

So what now?

I’ll save that for another post, I just wanted to get rid of any remaining memories of 2022.

I certainly hope the skies clear and the seas calm a bit, but I will not be setting sail anytime soon. Gonna stay close to the shore for the time being.

Happy New Year! (let’s hope)